Understanding the New York session in Kenyan time is essential for traders who want to trade when the market is most active and liquid. This session is where major price moves often happen, especially in forex, indices, and commodities. Knowing the correct hours in Kenya helps you plan trades, manage risk, and avoid guessing when volatility will increase.

The New York session is closely linked with major financial institutions in the United States, and it overlaps with the London session. This overlap is what makes it one of the most important trading windows in the global markets.

What Is the New York Trading Session?

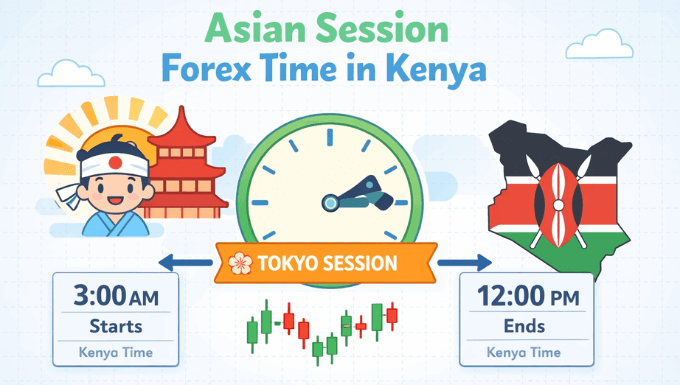

The New York trading session is one of the three main forex market sessions, alongside the Asian and London sessions. It represents trading activity coming from North America and is heavily influenced by US economic data and market sentiment.

This session is known for strong momentum, sharp price movements, and high trading volume. Many professional traders focus on this period because trends often start, continue, or reverse during New York hours.

New York Session Opening and Closing Times in Kenya

To trade effectively, you need the exact time the New York session runs in Kenyan time. Kenya operates on East Africa Time (EAT), which is UTC +3 and does not change during the year.

New York Session Time in Kenya (Standard Period)

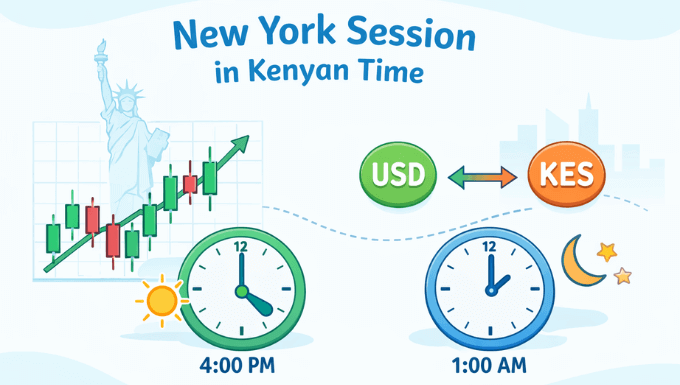

During the period when the United States is on standard time, the New York session runs:

- Opening time: 4:00 PM Kenyan time

- Closing time: 1:00 AM Kenyan time (next day)

This period usually applies from early November to early March.

New York Session Time in Kenya (Daylight Saving Period)

When the United States switches to daylight saving time, the New York session shifts one hour earlier for Kenyan traders:

- Opening time: 3:00 PM Kenyan time

- Closing time: 12:00 AM Kenyan time (midnight)

This period usually runs from March to November.

Why the Time Changes Matter

The time shift can affect your routine, especially if you trade after work or in the evening. Missing this adjustment may cause you to enter trades too early or too late, reducing their effectiveness.

Visual Overview of the New York Session in Kenyan Time

A simple visual timeline helps put the New York session into perspective and shows how it fits into the full trading day.

This visual makes it easier to see when volatility increases and how the New York session overlaps with other sessions.

The London–New York Overlap and Why It Matters

One of the most important periods in forex trading is the overlap between the London and New York sessions. This overlap usually lasts for about three to four hours, depending on daylight saving changes.

During this time, both European and US traders are active. Liquidity is at its highest, spreads are usually tighter, and price movements tend to be clearer and more decisive.

Best Time to Trade During the New York Session in Kenya

Not all hours of the New York session behave the same way. Some periods are more suitable for active trading than others.

Early New York Session

The first two to three hours after the New York market opens are often the most volatile. Major economic news from the US is commonly released during this window, which can cause sharp moves.

Mid-Session Period

After the initial burst of activity, the market may slow down slightly. Price action can still be tradable, but movements are often more structured and less explosive.

Late New York Session

As the session approaches closing time, liquidity gradually drops. Many traders reduce activity during this period because price movements can become choppy.

Currency Pairs That Move Most in the New York Session

Some currency pairs are especially active during the New York session due to the US dollar involvement. These pairs often show stronger trends and clearer setups.

Commonly active pairs include:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CAD

These pairs respond quickly to US economic news and sentiment during New York hours.

Key Economic News Released During the New York Session

The New York session is heavily driven by economic announcements from the United States. These reports often set the tone for the day and can influence global markets.

Important releases include employment data, inflation figures, interest rate decisions, and consumer sentiment reports. Traders should always check an economic calendar before trading to avoid being caught off guard by sudden volatility.

Trading Styles That Work Well in the New York Session

Different trading approaches perform better during New York hours due to increased liquidity and momentum.

Day Trading

Day traders benefit from fast price movements and clear intraday trends. The New York session provides enough volatility to find multiple setups within a short time.

Breakout Trading

Breakouts are common, especially during the London–New York overlap. Strong moves often occur when the price breaks key support or resistance levels.

News-Based Trading

For experienced traders, trading around major US news releases can offer opportunities. This approach requires strict risk control due to sudden price spikes.

Risk Management Tips for Kenyan Traders

High volatility can be both an opportunity and a risk. Proper risk management is essential when trading the New York session.

Always use stop-loss orders and avoid overleveraging your account. It is also wise to reduce position size during major news events if you are not specifically trading the news.

Is the New York Session Suitable for Beginners?

The New York session can be suitable for beginners, but only with the right approach. The clear price movements can make market structure easier to read compared to quieter sessions.

However, beginners should start with a demo account and focus on simple strategies. Understanding session timing and practicing patience are more important than chasing every move.

Final Thoughts on the New York Session in Kenyan Time

The New York session in Kenyan time offers some of the best trading opportunities in the forex market due to high liquidity and strong price action. By knowing the correct hours, adjusting for daylight saving time, and choosing the right trading style, Kenyan traders can trade with more confidence and consistency.

When approached with discipline and proper risk management, the New York session can become a valuable part of a well-balanced trading routine.

Vincent Nyagaka has been trading and analyzing markets for over 10+ years. He is a respected trader, author, and coach in financial markets, and is known as the authority on price action trading. At Eazypips, he shares practical strategies and trading lessons to guide aspiring traders toward consistent results.