The London session forex time in Kenya is one of the most important trading windows for currency traders who want strong price movement and reliable liquidity. This session connects African traders directly to the largest financial hub in the global forex market, creating opportunities that are difficult to find at other times of day.

Understanding the exact timing, seasonal changes, and market behavior during the London session helps Kenyan traders plan their day with confidence. When you know when volatility rises and which pairs move most, trading becomes more structured and less stressful.

What the London forex session represents

The London session represents the period when major European banks, institutions, and professional traders are active in the market. Because London handles a large share of global forex transactions, price action during this session is often cleaner and more decisive.

This session is known for strong trends, tighter spreads, and consistent volume. Many daily highs and lows are formed during London hours, making it a key reference point for technical and intraday traders.

London session forex time in Kenya explained clearly

The London forex session runs from 8:00 AM to 5:00 PM London time, but the exact Kenyan time depends on daylight saving changes in the United Kingdom. Kenya does not observe daylight saving time, so the session shifts slightly during the year.

During the UK winter (Greenwich Mean Time), the London session in Kenya runs from 11:00 AM to 8:00 PM EAT. During UK summer (British Summer Time), the session starts one hour earlier, running from 10:00 AM to 7:00 PM EAT.

This small shift has a real impact on daily trading routines. Kenyan traders who track these seasonal changes avoid entering the market too early or missing the most active hours.

How daylight saving time affects Kenyan traders

Daylight saving time in the UK usually starts in late March and ends in late October. When the clocks move forward in London, the forex market opens earlier for traders in Kenya.

This change often catches beginners off guard, especially those who rely on fixed schedules. Checking your trading platform’s server time and confirming session hours at the start of each season helps prevent timing errors.

Why the London session matters so much in Kenya

The London session matters because it offers the best balance between volatility and structure. Prices tend to move with purpose rather than random spikes, which is ideal for both technical and price-action traders.

For Kenyan traders, the timing is also practical. The session overlaps with normal working hours, making it easier to trade without staying up late or waking before sunrise.

The London–New York overlap and its importance

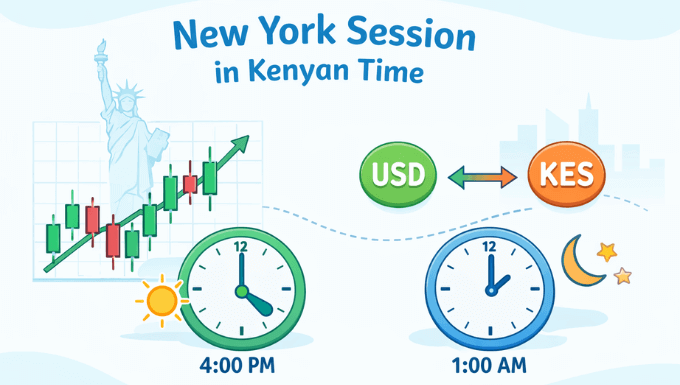

The most active period of the trading day occurs when the London and New York sessions overlap. For Kenyan traders, this overlap usually runs from 3:00 PM to 7:00 PM EAT, depending on the season.

During this window, trading volume increases sharply as European and American institutions operate at the same time. Many strong breakouts, reversals, and continuation moves occur during this overlap, making it a favorite time for intraday traders.

Best currency pairs to trade during the London session

The London session is especially suitable for currency pairs that include the euro, British pound, and US dollar. These pairs see deep liquidity and tighter spreads during European hours.

Popular choices include:

- EUR/USD for steady trends and clean technical setups

- GBP/USD for higher volatility and faster price movement

- EUR/GBP for range-based strategies and intraday trades

These pairs respond well to support and resistance levels formed during the Asian session, giving traders clear reference points.

Typical market behavior during London hours

Price action during the London session often begins with a breakout from the Asian session range. This early movement sets the tone for the rest of the day and can develop into a strong trend.

Mid-session trading tends to slow slightly before activity increases again during the London–New York overlap. Recognizing these rhythm changes helps traders avoid overtrading during quieter moments.

Who benefits most from trading the London session in Kenya

Scalpers benefit from tight spreads and fast execution during London hours. Short-term traders often find enough movement to meet daily targets without excessive risk.

Swing traders also gain value from this session because many higher-timeframe moves begin in London. Even if trades are held longer, entries during this session are often more reliable.

Risk management during the London session

High volatility brings opportunity, but it also increases risk if position sizes are too large. Kenyan traders should adjust stop-loss levels to match the faster pace of price movement during London hours.

Using a fixed risk percentage per trade and avoiding emotional entries during news releases helps protect capital. Consistency matters more than catching every move.

Common mistakes Kenyan traders make during the London session

One common mistake is trading immediately at session open without confirmation. Early volatility can create false breakouts that trap impatient traders.

Another issue is ignoring economic news from the UK and Europe. Major announcements can change market direction quickly, so checking the economic calendar before trading is essential.

How to build a daily routine around the London session

A solid routine starts with market analysis before the session opens. Marking key support and resistance levels early prepares you for potential breakouts.

During active hours, focus only on your best setups and avoid constant chart switching. After the session ends, reviewing trades helps improve discipline and long-term performance.

Final thoughts on the London session forex time in Kenya

The London session forex time in Kenya offers some of the best trading conditions available in the global currency market. With clear timing, strong liquidity, and consistent price action, it suits both beginners and experienced traders.

By understanding seasonal time changes, focusing on the right currency pairs, and maintaining disciplined risk management, Kenyan traders can use the London session as a reliable foundation for long-term trading success.

Vincent Nyagaka has been trading and analyzing markets for over 10+ years. He is a respected trader, author, and coach in financial markets, and is known as the authority on price action trading. At Eazypips, he shares practical strategies and trading lessons to guide aspiring traders toward consistent results.