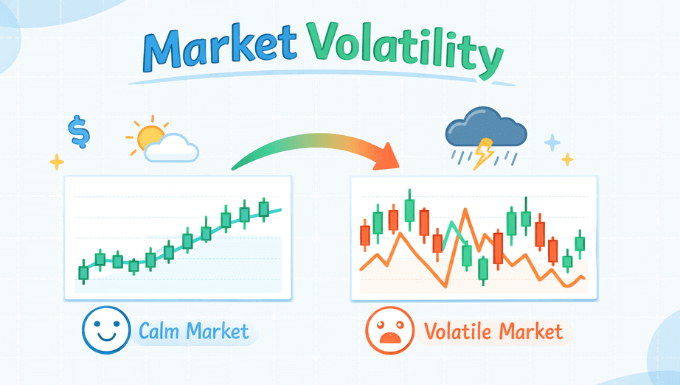

Volatility is a term that often comes up when discussing financial markets, but what does it really mean? In simple terms, volatility refers to the extent of price fluctuations in a market or asset over a specific period. High volatility means prices are changing rapidly, while low volatility indicates more stable prices.

Understanding volatility is crucial because it helps investors, traders, and analysts gauge the level of risk associated with different investments. By examining market volatility, you can anticipate the potential for gains or losses, which is fundamental to making informed decisions.

What Causes Volatility?

Volatility in financial markets doesn’t appear out of nowhere; it is driven by several factors, both external and internal. Let’s break down some of the key contributors:

1. Economic Events

Major economic announcements, such as GDP growth reports, inflation data, or employment figures, can trigger market reactions. When these numbers come in much higher or lower than expected, they can lead to sharp price swings as traders adjust their positions based on new information.

2. Geopolitical Tensions

Conflicts, elections, and policy changes in key global regions can create uncertainty, prompting market participants to react quickly. Events like a military conflict, changes in government policies, or natural disasters can all contribute to sudden spikes in volatility.

3. Market Sentiment

The collective psychology of investors can have a profound impact on volatility. For instance, if investors suddenly become more risk-averse or fear an economic downturn, markets can become more volatile as people rush to sell or buy assets.

4. Market Liquidity

Liquidity refers to how easily an asset can be bought or sold without affecting its price. When liquidity is low, volatility tends to rise because large trades can move the market significantly, leading to unpredictable price changes.

5. Central Bank Policies

Monetary policies set by central banks, like the Federal Reserve in the United States, can also influence volatility. Interest rate changes, quantitative easing programs, and other monetary interventions can create dramatic shifts in market conditions.

Types of Volatility

Not all volatility is the same. It’s important to distinguish between different types of volatility to understand their impact better. Here are the most common types:

1. Historical Volatility

Historical volatility measures past price fluctuations over a specific time period. Traders use this type of volatility to understand how much an asset has moved in the past, which can help predict future price movements.

2. Implied Volatility

Implied volatility is a forecast of future price movements, derived from options prices. Higher implied volatility often means higher options premiums, as investors expect larger price swings.

3. Volatility Index (VIX)

The VIX, also known as the “fear gauge,” measures market expectations of future volatility. It is commonly used to assess investor sentiment. A rising VIX typically indicates growing fear or uncertainty in the markets, while a low VIX suggests that investors are more confident.

How Volatility Affects Investors

Volatility can have both positive and negative effects on different types of investors. Understanding how to navigate volatile markets is key to managing risks effectively.

1. Risk to Long-Term Investors

For long-term investors, volatility can be unsettling. Price swings may lead to short-term losses, but if an investor’s strategy is focused on long-term growth, volatility may present opportunities to buy quality assets at lower prices. However, excessive volatility can also make long-term planning more difficult, as unpredictable market conditions can affect retirement accounts and investment goals.

2. Opportunities for Short-Term Traders

For short-term traders, volatility can present exciting opportunities. Traders use volatility to make quick profits from price swings within a short period. This is particularly true for day traders and swing traders who thrive on market fluctuations. However, volatility can also increase the risks of significant losses if the market moves unexpectedly against their positions.

3. Options Traders and Volatility

Options traders often use volatility to their advantage. The pricing of options contracts is heavily influenced by implied volatility. When volatility rises, option premiums increase, making it a potentially profitable time to sell options. Conversely, when volatility drops, options premiums may decrease, which could be a good time for buying options.

Managing Volatility Risk

While volatility is an inherent part of investing, there are several strategies that investors can employ to manage the risks associated with it.

1. Diversification

One of the most effective ways to manage volatility risk is through diversification. By spreading investments across different asset classes, sectors, and geographies, you can reduce the impact of a downturn in any one area of the market. This approach helps to smooth out the volatility of individual investments.

2. Hedging with Derivatives

Another strategy used by more advanced investors is hedging. Hedging involves using financial instruments like options or futures contracts to offset potential losses in an investment portfolio. For example, if you anticipate that a market may become volatile, you might buy put options on an index to protect against falling prices.

3. Stop-Loss Orders

Stop-loss orders are a simple but effective tool for limiting losses. A stop-loss order automatically triggers a sale of an asset when its price falls below a predetermined level. This can help protect investors from large, unexpected price movements during periods of high volatility.

4. Investing in Volatility Products

Some investors choose to invest in volatility products, such as ETFs that track the VIX or other volatility indices. These products can serve as a hedge against market declines or be used for speculative purposes in volatile periods.

Conclusion

Volatility plays a central role in financial markets, and while it can be unsettling, it also provides opportunities for those who know how to navigate it. By understanding the causes, types, and impacts of volatility, investors can develop strategies to manage risk and even take advantage of price fluctuations.

Whether you’re a long-term investor focused on growth or a short-term trader looking to profit from market swings, being prepared for volatility is essential. With the right knowledge and tools, volatility doesn’t have to be something to fear—it can be an opportunity for growth and profit.

Final Thoughts:

In the world of finance, volatility is a crucial factor to understand. It is not just a random occurrence but a product of various economic, geopolitical, and market factors. By staying informed and employing smart strategies, investors can turn the challenge of volatility into an advantage.