Short selling is a trading strategy that allows investors to profit when the price of an asset falls instead of rises. Unlike traditional investing, where you buy low and sell high, short selling reverses this logic by selling first and buying later. This approach is widely used in stock markets, forex, and other financial markets, but it comes with unique risks that every trader should understand.

In this guide, you will learn what short selling is, how it works step by step, why traders use it, and the real risks involved. The explanation is practical, beginner-friendly, and grounded in how short selling actually works in modern financial markets.

What Is Short Selling?

Short selling is the act of selling a financial asset that you do not currently own, with the intention of buying it back later at a lower price. The difference between the selling price and the buying price becomes your profit or loss.

This strategy is based on the belief that an asset is overvalued or likely to decline due to weak fundamentals, poor earnings, or negative market sentiment. Short selling is common among professional traders, hedge funds, and experienced retail traders who can manage its risks.

How Short Selling Works Step by Step

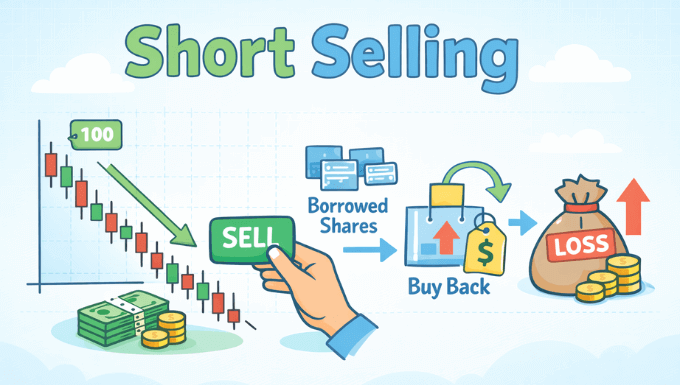

Short selling follows a structured process that involves borrowing, selling, and repurchasing an asset. Understanding each step helps clarify why this strategy is riskier than traditional investing.

First, your broker lends you shares of a stock or another tradable asset. These shares are borrowed from the broker’s inventory or from another investor’s holdings.

Second, you sell the borrowed shares at the current market price. At this point, you receive cash, but you still owe the broker the same number of shares.

Third, you wait and monitor the market. If the asset price falls as expected, you buy back the shares at the lower price.

Finally, you return the repurchased shares to the broker. Your profit is the difference between the selling price and the buying price, minus fees and interest.

A Simple Short Selling Example

A clear example makes short selling easier to understand in practice.

Assume a stock is trading at $100, and you believe it is overvalued. You borrow one share and sell it at $100. A week later, the stock drops to $70. You buy the share back at $70 and return it to your broker.

Your gross profit is $30, excluding brokerage fees and borrowing costs. If the stock had risen to $130 instead, your loss would be $30, and that loss could continue to grow if the price keeps rising.

Why Traders Use Short Selling

Short selling serves several important purposes in financial markets. It is not only about speculation but also about risk management and market efficiency.

Some traders use short selling to profit from falling markets during economic downturns or company-specific crises. Others use it to hedge existing investments, reducing overall portfolio risk.

Short selling also plays a role in price discovery. By allowing negative views to be expressed through trades, markets can more accurately reflect the true value of assets.

Short Selling vs Traditional Investing

Short selling differs fundamentally from the classic buy-and-hold approach used by long-term investors.

Traditional investing focuses on owning assets and benefiting from price appreciation and dividends over time. The maximum loss is limited to the amount invested.

Short selling, on the other hand, does not involve ownership and has theoretically unlimited loss potential. This difference makes short selling suitable only for traders who understand leverage, risk controls, and market behavior.

Markets Where Short Selling Is Common

Short selling is available in several financial markets, though rules and accessibility vary by region and broker.

In the stock market, short selling is widely used for individual stocks and exchange-traded funds. In forex trading, selling a currency pair is essentially a form of short selling, as you are selling one currency against another.

Short selling is also present in commodities, indices, and cryptocurrencies, often through derivatives such as contracts for difference (CFDs) and futures.

Risks of Short Selling

Short selling carries unique risks that make it more dangerous than many other trading strategies. These risks must be clearly understood before attempting to short any asset.

The most significant risk is unlimited losses. Since there is no limit to how high a price can rise, losses can exceed your initial capital.

Another risk is margin calls. Brokers require margin to maintain short positions, and if the price rises sharply, you may be forced to add funds or close the trade at a loss.

Short sellers are also exposed to sudden price spikes caused by news, earnings reports, or market squeezes.

What Is a Short Squeeze?

A short squeeze occurs when a heavily shorted asset rises rapidly in price, forcing short sellers to buy back shares to limit their losses. This buying pressure pushes prices even higher, creating a feedback loop.

Short squeezes are often triggered by positive news or coordinated buying. They can lead to extreme volatility and rapid losses for short sellers.

Understanding short interest and market sentiment is essential to avoiding or managing the risk of a short squeeze.

Costs and Fees Associated With Short Selling

Short selling is not free, and costs can reduce or eliminate profits.

Traders often pay borrowing fees or interest for the shares they borrow. These costs can increase if the asset is in high demand or hard to borrow.

Additional costs include trading commissions, margin interest, and potential dividend payments if the asset pays dividends while you hold the short position.

Rules and Regulations Around Short Selling

Short selling is regulated to maintain market stability and prevent abuse. Regulations vary by country and market.

Some markets impose short-selling bans during periods of extreme volatility. Others require disclosure of large short positions.

In many jurisdictions, traders must comply with “uptick rules” or locate requirements that ensure shares can be borrowed before selling.

Is Short Selling Ethical?

Short selling is sometimes controversial, but it is a legal and widely accepted market practice.

Critics argue that short selling can increase market volatility and harm companies. Supporters counter that it exposes fraud, overvaluation, and weak business models.

From a market perspective, short selling contributes to transparency and efficiency by allowing negative information to be reflected in prices.

Who Should Consider Short Selling?

Short selling is best suited for experienced traders who understand market dynamics and risk management.

Traders with strong technical analysis skills and access to reliable fundamental research are better positioned to identify overvalued assets.

Beginners are generally advised to learn market behavior and risk control through traditional trading before exploring short-selling strategies.

Risk Management Strategies for Short Selling

Effective risk management is essential when engaging in short selling.

Using stop-loss orders helps limit losses if the market moves against you. Position sizing ensures that no single trade can severely damage your account.

Diversification and avoiding emotional decision-making are also critical. Short selling requires discipline, patience, and a clear trading plan.

Short Selling Advantages and Disadvantages

Short selling has both benefits and drawbacks that must be weighed carefully.

Advantages include:

- Ability to profit in falling markets

- Portfolio hedging against downturns

- Contribution to market efficiency

Disadvantages include:

- Unlimited loss potential

- High emotional and financial stress

- Additional costs and regulatory constraints

Understanding both sides helps traders decide whether short selling fits their strategy.

Short Selling in Forex Trading

In forex markets, short selling is more straightforward and less restrictive.

When you sell a currency pair, you are effectively shorting the base currency and buying the quote currency. This structure makes short selling a natural part of forex trading.

However, leverage in forex amplifies both gains and losses, making risk management just as important as in stock markets.

Common Myths About Short Selling

Short selling is often misunderstood, leading to persistent myths.

One common myth is that short sellers want companies to fail. In reality, most short sellers focus on price movements, not company outcomes.

Another myth is that short selling is gambling. While risky, it is a structured strategy based on analysis, not chance.

Final Thoughts

Short selling is a powerful but complex trading strategy that allows investors to profit from falling prices. When used responsibly, it can serve as a valuable tool for speculation, hedging, and market analysis.

At the same time, the risks are real and can be severe without proper knowledge and discipline. Anyone considering short selling should invest time in learning, practice with risk controls, and fully understand how losses can unfold.

When approached with respect for risk and a solid trading plan, short selling can be a legitimate and effective part of an advanced trading strategy.