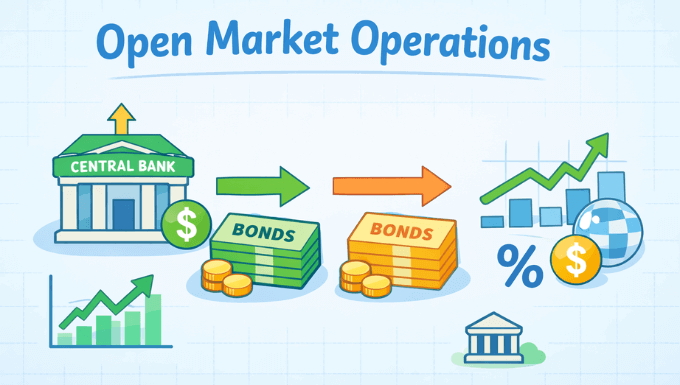

Open Market Operations (OMO) are one of the most important tools used by central banks to control money supply and short-term interest rates in an economy. They involve the buying and selling of government securities in the open market to influence liquidity in the banking system.

In the first place, Open Market Operations matter because they directly affect how much money banks have available to lend. When central banks adjust liquidity through OMO, the effects quickly spread to interest rates, inflation, exchange rates, and overall economic activity.

What Are Open Market Operations?

Open Market Operations refer to the routine purchase or sale of government bonds and treasury bills by a central bank. These transactions are carried out with commercial banks and other financial institutions, not directly with the public.

The main goal of Open Market Operations is to regulate the amount of money circulating in the economy. By changing bank reserves, central banks guide short-term interest rates toward their policy targets.

Why Central Banks Use Open Market Operations

Central banks rely on Open Market Operations because they are flexible, precise, and effective. Unlike administrative controls, OMO allows policymakers to respond quickly to changing economic conditions.

Another reason OMOs are widely used is that they work smoothly within market systems. Instead of forcing banks to act, central banks influence incentives through liquidity and interest rates.

How Open Market Operations Work

At the heart of Open Market Operations is the relationship between bank reserves and interest rates. When reserves increase, borrowing becomes cheaper; when reserves fall, borrowing becomes more expensive.

Central banks conduct OMO through auctions or direct market transactions. Commercial banks adjust their lending, deposits, and pricing based on the new liquidity conditions created by these operations.

Expansionary Open Market Operations

Expansionary Open Market Operations are used when economic growth is weak or inflation is too low. In this case, the central bank buys government securities from the market.

By purchasing securities, the central bank injects money into the banking system. Banks gain additional reserves, which encourages more lending, lower interest rates, and increased economic activity.

Contractionary Open Market Operations

Contractionary Open Market Operations are applied when inflation is rising too fast, or the economy is overheating. Here, the central bank sells government securities into the market.

When banks buy these securities, money flows out of the banking system. This reduces excess reserves, raises interest rates, and slows borrowing and spending.

Types of Open Market Operations

Open Market Operations are not all conducted in the same way. Central banks use different forms depending on how long they want the liquidity effect to last.

Permanent Open Market Operations

Permanent Open Market Operations involve outright purchases or sales of securities. These transactions permanently change the level of money supply in the economy.

They are usually used to support long-term policy goals, such as maintaining price stability or supporting sustained economic growth.

Temporary Open Market Operations

Temporary Open Market Operations are designed to manage short-term liquidity needs. The most common examples are repurchase agreements (repos) and reverse repos.

In a repo, the central bank lends money to banks with an agreement to reverse the transaction later. In a reverse repo, the central bank absorbs liquidity temporarily by borrowing funds from banks.

Open Market Operations vs Other Monetary Policy Tools

Open Market Operations work alongside other monetary policy tools, but they are often the preferred option. Each tool affects the economy in a slightly different way.

Interest rate policy sets the target cost of borrowing, while reserve requirements control how much banks must hold back. Open Market Operations act as the day-to-day mechanism that keeps market rates aligned with policy goals.

Role of Open Market Operations in Inflation Control

Inflation control is one of the main reasons central banks actively use Open Market Operations. By managing liquidity, central banks influence demand pressures across the economy.

When inflation rises, contractionary OMO reduces excess money chasing goods and services. When inflation falls too low, expansionary OMO stimulates spending and investment.

Impact of Open Market Operations on Interest Rates

Short-term interest rates respond quickly to Open Market Operations. Changes in bank reserves directly affect interbank lending rates and money market conditions.

Over time, these changes influence broader interest rates, including loans, mortgages, and bond yields. This is how OMO transmits monetary policy to households and businesses.

Open Market Operations and the Foreign Exchange Market

Open Market Operations can also influence exchange rates, even though that is not always their primary goal. Changes in interest rates affect capital flows between countries.

Higher interest rates often attract foreign investment, strengthening the local currency. Lower interest rates may reduce capital inflows, putting downward pressure on the currency.

Who Conducts Open Market Operations?

Open Market Operations are carried out by central banks or their designated monetary policy committees. Each central bank has its own operational framework.

Examples include the Federal Reserve, the European Central Bank, and the Bank of England. While methods differ slightly, the core principles remain the same worldwide.

Advantages of Open Market Operations

Open Market Operations offer several practical benefits for monetary authorities. These advantages explain why OMO is the primary policy tool in most modern economies.

- They are flexible and can be adjusted frequently

- They work through market mechanisms rather than direct controls

- They provide clear signals to financial markets

Limitations of Open Market Operations

Despite their effectiveness, Open Market Operations are not perfect. Their success depends on a well-functioning financial system and responsive banks.

In times of financial crisis, banks may be unwilling to lend even when liquidity is abundant. In such cases, OMO alone may not be enough to stimulate the economy.

Open Market Operations in Developing Economies

In developing and emerging economies, Open Market Operations can be more challenging to implement. Financial markets may be shallow or less liquid.

Even so, many developing countries still use OMO alongside other tools. Over time, improving market infrastructure increases the effectiveness of these operations.

Real-World Example of Open Market Operations

A clear example of Open Market Operations occurs during an economic slowdown. A central bank may buy large amounts of government bonds to lower interest rates and encourage lending.

This approach was widely used after the global financial crisis, helping stabilize markets and support recovery when private spending weakened.

Why Open Market Operations Matter to Traders and Investors

Open Market Operations are closely watched by traders, investors, and financial institutions. Liquidity changes often influence asset prices, bond yields, and currency movements.

Understanding OMO helps market participants anticipate policy direction and manage risk more effectively. It is especially relevant in forex, bond, and money markets.

Key Takeaways

Open Market Operations are a core pillar of modern monetary policy. They allow central banks to guide money supply and interest rates through market-based transactions.

For both beginners and experienced readers, understanding OMO provides valuable insight into how central banks influence inflation, growth, and financial stability.