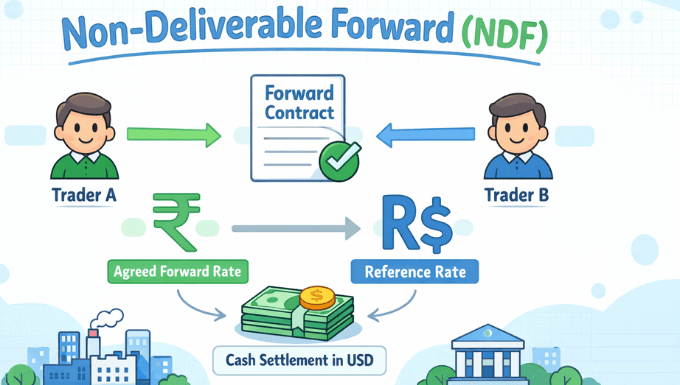

A Non-Deliverable Forward is a financial contract that allows two parties to hedge or speculate on a future exchange rate without physically exchanging the underlying currencies. Instead of delivering the currencies at maturity, the contract is settled in cash based on the difference between the agreed forward rate and a reference spot rate.

This structure exists mainly because some currencies are not freely convertible or are subject to capital controls. By using a Non-Deliverable Forward, market participants can still manage currency risk or express a view on exchange rates while complying with local regulations.

- Why Non-Deliverable Forwards Exist

- How a Non-Deliverable Forward Works

- Key Currencies Traded Using NDFs

- Who Uses Non-Deliverable Forwards

- Pricing and Valuation of NDFs

- Benefits of Using Non-Deliverable Forwards

- Risks Associated With Non-Deliverable Forwards

- Regulatory and Compliance Considerations

- NDFs Compared to Deliverable Forwards

- When a Non-Deliverable Forward Makes Sense

- Final Thoughts

Why Non-Deliverable Forwards Exist

Non-Deliverable Forwards were created to solve a practical problem faced by international businesses and investors. When a currency cannot be easily delivered outside its home country, traditional forward contracts become difficult or impossible to use.

NDFs bridge this gap by shifting settlement into a widely traded currency, usually the US dollar. This approach allows global participants to manage exposure while avoiding the legal and operational barriers associated with restricted currencies.

How a Non-Deliverable Forward Works

A Non-Deliverable Forward follows a clear and predictable process from initiation to settlement. While the mechanics are straightforward, understanding each step helps reduce confusion and misuse.

Agreement on Contract Terms

At the start, both parties agree on the notional amount, the forward exchange rate, the fixing date, and the settlement date. The notional amount represents exposure only and is never physically exchanged.

These terms are negotiated over the counter, meaning the contract is customized rather than traded on an exchange. This flexibility is one reason NDFs are popular with institutional participants.

Fixing Date and Reference Rate

On the fixing date, an official or widely accepted spot exchange rate is observed. This rate comes from a predefined source agreed upon in the contract.

The reference rate acts as the benchmark against which the forward rate is compared. Transparency at this stage is essential to ensure both parties accept the outcome.

Cash Settlement

On the settlement date, the difference between the agreed forward rate and the reference spot rate is calculated. The party benefiting from the rate movement receives a cash payment, typically in US dollars.

No local currency changes hands at any point. This cash-only settlement is what makes the Non-Deliverable Forward distinct from standard forward contracts.

Key Currencies Traded Using NDFs

Non-Deliverable Forwards are most common in markets where currency controls or limited convertibility exist. These currencies often attract strong interest from global investors and multinational companies.

Commonly traded NDF currencies include those from parts of Asia, Latin America, Eastern Europe, and Africa. Trading activity tends to increase during periods of economic uncertainty or policy change.

Who Uses Non-Deliverable Forwards

A wide range of participants rely on Non-Deliverable Forwards for different objectives. Each group approaches NDFs with distinct risk considerations and time horizons.

Corporations and Importers

Companies with revenues or costs in restricted currencies use NDFs to stabilize cash flows. By locking in an exchange rate, they reduce uncertainty in budgeting and financial reporting.

This approach is especially valuable for firms operating across borders where currency volatility can quickly erode profit margins.

Banks and Financial Institutions

Banks act as market makers, providing liquidity and pricing for Non-Deliverable Forwards. They also use NDFs to manage their own exposure arising from client activity.

Risk management systems play a central role here, as NDF positions can be sensitive to sudden policy shifts or macroeconomic news.

Traders and Investors

Professional traders and hedge funds use NDFs to express views on currency movements. Because NDFs are leveraged instruments, small price changes can lead to significant gains or losses.

This makes disciplined risk control essential, particularly during volatile market conditions.

Pricing and Valuation of NDFs

Pricing a Non-Deliverable Forward depends on interest rate differentials, expected currency movements, and market liquidity. While the formula resembles that of deliverable forwards, practical pricing reflects additional risk premiums.

Political stability, central bank policy, and capital flow restrictions all influence NDF pricing. As a result, NDF rates may diverge noticeably from onshore forward rates.

Benefits of Using Non-Deliverable Forwards

Non-Deliverable Forwards offer several advantages when used appropriately. These benefits explain their continued relevance in global currency markets.

- Access to hedging in restricted currency markets

- No need to handle or settle in local currency

- Customizable contract terms

- Widely used and understood by institutional participants

When aligned with a clear risk management strategy, NDFs can be efficient and practical tools.

Risks Associated With Non-Deliverable Forwards

Despite their usefulness, Non-Deliverable Forwards carry meaningful risks that should not be overlooked. Understanding these risks is essential before entering into any contract.

Market Risk

Exchange rates can move sharply due to economic data, policy decisions, or geopolitical events. Such movements can lead to losses if the market moves against the position.

Because NDFs are often leveraged, losses may exceed initial expectations if risk controls are weak.

Counterparty Risk

NDFs are over-the-counter instruments, meaning settlement depends on the other party honoring the contract. If a counterparty fails, the expected payment may not be received.

This risk is typically managed through credit assessments, collateral agreements, or trading with well-capitalized institutions.

Liquidity Risk

Not all NDF markets are equally liquid. During stressed conditions, spreads can widen and exiting a position may become costly.

Liquidity risk is particularly relevant for longer-dated contracts or less frequently traded currencies.

Regulatory and Compliance Considerations

Regulation plays a central role in Non-Deliverable Forward markets. Authorities monitor NDF activity closely due to its connection with capital flows and currency stability.

Participants must ensure compliance with reporting requirements, margin rules, and local regulations. Failure to do so can result in financial penalties or trading restrictions.

NDFs Compared to Deliverable Forwards

While both instruments aim to manage currency risk, their structure and use cases differ. Understanding these differences helps in choosing the right tool.

Deliverable forwards involve actual exchange of currencies at maturity, making them suitable for freely convertible currencies. Non-Deliverable Forwards avoid physical delivery, which makes them practical where delivery is restricted or impractical.

When a Non-Deliverable Forward Makes Sense

A Non-Deliverable Forward is most appropriate when exposure exists in a currency that cannot be easily delivered offshore. It is also useful when regulatory constraints limit access to onshore hedging tools.

Used thoughtfully, NDFs can complement broader risk management strategies rather than replace them entirely.

Final Thoughts

A Non-Deliverable Forward is a specialized yet powerful instrument designed to address real-world market limitations. Its value lies in flexibility, accessibility, and the ability to manage currency risk without breaching local controls.

For businesses, banks, and professional investors, understanding how NDFs work—and when to use them—can make a meaningful difference in managing exposure and navigating complex currency markets.