A Marubozu candlestick is one of the most important and straightforward chart patterns used in technical analysis. It represents a strong market sentiment, either bullish or bearish, and is characterized by a lack of shadows or wicks at both ends of the candlestick.

This pattern indicates that the price opened at one extreme and closed at the other, showing dominance by either buyers or sellers throughout the trading period.

For traders, understanding the Marubozu pattern can provide valuable insights into the market’s direction. Whether you are a beginner or an experienced trader, recognizing and interpreting this candlestick formation can enhance your decision-making process and improve your trading strategies.

How to Identify a Marubozu Candlestick?

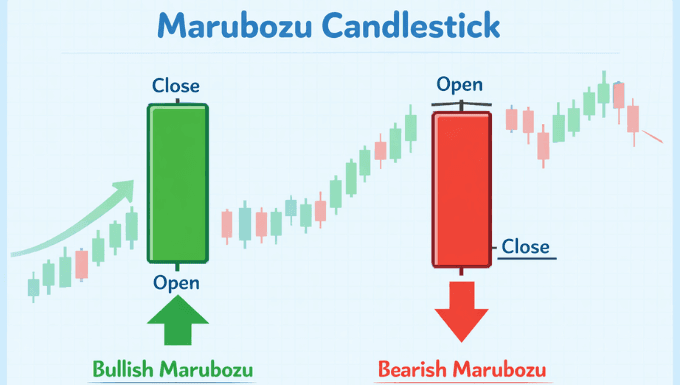

A Marubozu candlestick is easily identifiable due to its lack of wicks, or shadows, on either side of the body. The entire range between the open and close is filled, making the candlestick look solid. It can appear in two main forms:

- Bullish Marubozu: The candle opens at the low of the period and closes at the high, signaling that the buyers dominated the market throughout the trading session. It suggests strong upward momentum.

- Bearish Marubozu: The candle opens at the high and closes at the low, showing that sellers controlled the price action during the session, indicating strong downward momentum.

Types of Marubozu Candlesticks

Marubozu candlesticks come in different types, each offering different implications for market sentiment. Let’s break them down:

1. Bullish Marubozu

A bullish Marubozu occurs when the open price is at the lowest point of the candlestick, and the close is at the highest point. This indicates strong upward momentum. A full-body candlestick with no upper or lower shadow is seen as a clear signal of buying strength, with market participants confidently pushing the price higher throughout the trading period.

2. Bearish Marubozu

The bearish Marubozu is the opposite of the bullish version. In this pattern, the open price is at the highest point, and the close is at the lowest, with no upper or lower shadows. This suggests that the sellers dominated the entire session, driving the price down without any significant retracements. It serves as a strong indicator of bearish market conditions.

3. Long Marubozu vs. Short Marubozu

Marubozu candlesticks can also vary in size. A long Marubozu has a significant difference between the open and close prices, indicating a stronger and more dominant trend. A short Marubozu has a smaller body, suggesting a less aggressive but still noticeable market movement.

Why Are Marubozu Candlesticks Important?

The Marubozu candlestick is a key pattern because it provides clarity about the market’s direction. It eliminates the ambiguity often present in other candlestick patterns and allows traders to make more informed decisions. Here are a few reasons why it is so important:

- Indicates Market Sentiment: A bullish Marubozu shows strong buying interest, while a bearish one indicates powerful selling pressure.

- Clear Signal for Entry or Exit: Marubozu candlesticks are often used to signal potential entry or exit points in the market, making them highly valuable for day traders and swing traders alike.

- Helps Confirm Trend Reversals: When paired with other technical indicators, the Marubozu can help confirm a trend reversal, giving traders a higher probability of success in their trades.

How to Use Marubozu in Trading?

Marubozu candlesticks can be used in various trading strategies. Here’s how you can incorporate them into your trading plan:

1. Confirming Trends

When a Marubozu appears at the beginning of a trend, it can confirm the prevailing market sentiment. A bullish Marubozu that appears after a period of consolidation or at the start of an uptrend is a strong indication that the bulls are in control. Similarly, a bearish Marubozu at the start of a downtrend signals that sellers are asserting dominance.

2. Identifying Breakouts

Marubozu candlesticks are often seen at breakout points. If the price breaks out of a consolidation or pattern and forms a Marubozu, it suggests that the breakout is genuine and will likely continue in the same direction.

3. Using Marubozu in Conjunction with Other Patterns

Marubozu candlesticks can be combined with other candlestick patterns and technical indicators to refine trading decisions. For example, a Marubozu at a support or resistance level can enhance the reliability of the signal.

4. Risk Management

Since Marubozu candlesticks represent a strong market bias, they can also help set stop-loss levels. A stop-loss placed below a bearish Marubozu or above a bullish Marubozu can help protect against market reversals.

Marubozu in Different Timeframes

The Marubozu candlestick pattern is effective across different timeframes, from one-minute charts to daily charts. However, it is essential to consider the timeframe in which the pattern appears. In longer timeframes, the Marubozu is more reliable, as it reflects more significant market movements. On shorter timeframes, the pattern may be less reliable due to the noise and volatility in the market.

Key Takeaways

- The Marubozu is a solid candlestick with no wicks or shadows, indicating a strong trend in the market.

- A bullish Marubozu indicates upward momentum, while a bearish Marubozu suggests downward pressure.

- Traders use Marubozu candlesticks to confirm trends, identify breakout points, and manage risk.

- This pattern can appear on any timeframe, but it’s most reliable on longer charts.

Understanding the Marubozu candlestick pattern is crucial for traders who want to stay ahead of the market. Whether you are a beginner or an advanced trader, recognizing the Marubozu pattern can help you identify trends, validate breakouts, and make more informed trading decisions.