The inside bar candle is one of the simplest yet most powerful price action patterns used by traders across all markets. It appears when price pauses, compresses, and prepares for a potential move, making it especially valuable for timing entries with controlled risk. This guide explains the inside bar candle in plain language, shows how to read it correctly, and explains how to trade it with structure rather than guesswork.

What Is an Inside Bar Candle?

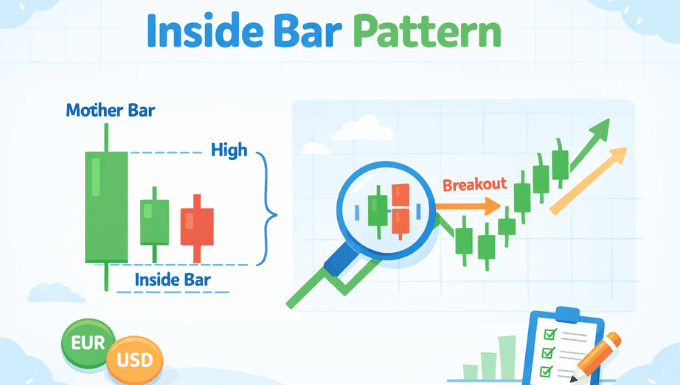

An inside bar candle is a price candle that forms completely within the high and low of the previous candle. The earlier candle is known as the mother bar, and the inside bar shows reduced volatility and temporary balance between buyers and sellers.

This pattern tells you that the market is pausing, not reversing or trending by itself. Price is contracting, and that contraction often leads to expansion once the pause ends.

How to Identify an Inside Bar Correctly

A proper inside bar must meet a clear structural rule. The high of the inside bar must be lower than the high of the mother bar, and the low must be higher than the low of the mother bar.

This strict definition matters because many traders mistakenly label similar candles as inside bars. Accuracy keeps your analysis clean and prevents false expectations.

Key Identification Rules

- The entire candle range fits inside the previous candle

- It can be bullish or bearish in color

- It works on any timeframe, from minutes to daily charts

What the Inside Bar Candle Represents in the Market

The inside bar represents indecision and compression, not direction. Buyers and sellers are temporarily balanced, often due to hesitation near a key level or after a strong move.

This balance creates stored energy. When the price finally breaks out of the mother bar range, that stored energy can drive a fast move, especially if volume and context support it.

Inside Bar vs Mother Bar Explained Simply

The relationship between the two candles is more important than their individual shapes. The mother bar defines the battlefield, while the inside bar shows hesitation inside that battlefield.

A large mother bar followed by a small inside bar often signals stronger potential than two similarly sized candles. Size contrast highlights a clear pause after expansion.

Bullish and Bearish Inside Bar Context

An inside bar does not automatically mean bullish or bearish. Direction depends entirely on where it forms and how the price breaks out.

A bullish outcome occurs when the price breaks above the mother bar high with conviction. A bearish outcome occurs when the price breaks below the mother bar low and holds.

Why Inside Bars Work So Well in Trading

Inside bars work because markets move through cycles of expansion and contraction. The inside bar captures the contraction phase in a very visible way.

This makes it useful for traders who want:

- Clear structure

- Defined risk

- Logical entries based on price behavior

It is not predictive by itself, but it becomes powerful when aligned with trends and key levels.

Best Market Conditions for Inside Bar Trading

Inside bars perform best when they appear in structured environments. Random markets reduce their reliability, while clean trends and levels improve results.

High-Probability Conditions

- Strong uptrend or downtrend

- Near support or resistance

- After an impulsive move

- At higher timeframes like H4 or Daily

How to Trade the Inside Bar Candle Step by Step

A structured approach removes emotion and guesswork. Trading the inside bar should always follow a clear plan.

Step 1: Identify the Context

Start by reading the broader market. Is price trending, ranging, or reacting to a key level? The inside bar must make sense within that picture.

Step 2: Mark the Mother Bar Range

Draw horizontal lines at the high and low of the mother bar. These levels define your potential breakout zones.

Step 3: Wait for the Break

Do not enter the range. Wait for the price to break and close beyond the mother bar high or low.

Step 4: Manage Risk Properly

Stops are typically placed on the opposite side of the mother bar. Position size should be adjusted so the risk stays consistent.

Common Inside Bar Trading Mistakes

Many losses come from misunderstanding what the pattern is meant to do. Avoiding these mistakes can dramatically improve results.

- Trading inside bars in choppy, low-quality markets

- Ignoring higher-timeframe direction

- Entering before a confirmed break

- Using the pattern without any supporting context

Inside Bar vs Other Candlestick Patterns

The inside bar is often confused with other candles, but its logic is unique. Unlike engulfing or pin bars, it does not show rejection.

It shows compression, which is why it pairs well with breakout and continuation strategies rather than reversal-only approaches.

Is the Inside Bar Candle Good for Beginners?

The inside bar is one of the best patterns for beginners because it is rule-based and visually clear. It teaches patience, discipline, and respect for structure.

New traders benefit most when they focus on quality setups rather than frequency. One clean inside bar at a strong level is more valuable than many random signals.

Final Thoughts on the Inside Bar Candle

The inside bar candle is not a magic signal, but it is a reliable building block of professional price action trading. When used with trend, structure, and disciplined risk management, it helps traders enter the market with clarity rather than emotion.

Mastering this pattern means learning when not to trade it as much as learning when to act. That balance is what separates consistent traders from impulsive ones.