Hawkish is a term used in economics and finance to describe a strong stance against inflation, even if it slows economic growth. When a policymaker or central bank is described as hawkish, it means they favor higher interest rates and tighter monetary policy to control rising prices.

In the first paragraph, it is important to understand that hawkish does not mean aggressive in a political sense. Instead, it reflects a priority: keeping inflation under control, sometimes at the cost of slower borrowing, spending, and investment.

What Does Hawkish Mean in Economics?

In economics, hawkish refers to a preference for policies that reduce inflation and prevent the economy from overheating. This approach assumes that unchecked inflation is more damaging in the long run than short-term economic slowdowns.

A hawkish stance usually appears when inflation is high or rising faster than expected. Policymakers then focus on tightening financial conditions to reduce demand and stabilize prices.

Hawkish vs Dovish: The Key Difference

Hawkish and dovish are opposite terms used to describe monetary policy attitudes. Understanding the difference helps investors and traders interpret central bank decisions more accurately.

A hawkish approach focuses on inflation control, while a dovish approach prioritizes economic growth and employment. These differences often shape interest rate decisions and market reactions.

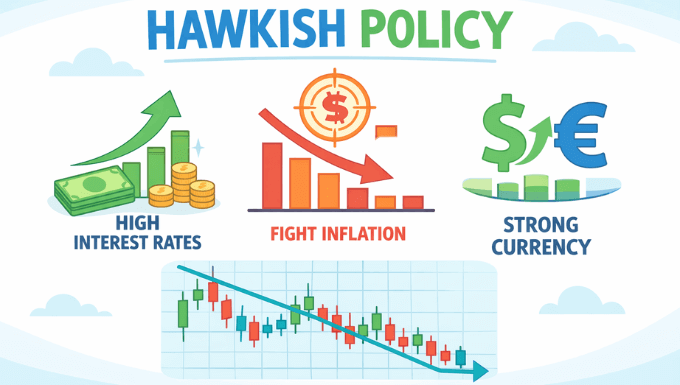

Hawkish Policy Characteristics

A hawkish policy stance is defined by actions that make borrowing more expensive. These actions are designed to slow spending and cool inflationary pressures.

Common hawkish signals include:

- Raising interest rates

- Reducing the money supply or liquidity

- Warning about inflation risks

- Supporting tighter financial conditions

Dovish Policy Characteristics

A dovish stance supports economic growth, especially during recessions or weak economic periods. Policymakers take this approach when inflation is low or economic activity is slowing.

Dovish signals often include lower interest rates, stimulus measures, and supportive language about growth and jobs.

What Is a Hawkish Central Bank?

A hawkish central bank is one that prioritizes inflation control over growth concerns. Such a bank is willing to raise interest rates even if it risks slowing the economy.

Well-known examples include the and the, which are often described as hawkish or dovish depending on economic conditions. Their policy tone strongly influences global financial markets.

Hawkish Monetary Policy

Hawkish monetary policy involves deliberate tightening to reduce inflationary pressure. Central banks use this policy when prices rise too quickly or inflation expectations become unstable.

This approach is based on the belief that long-term economic stability requires price control. While it may slow growth temporarily, it aims to protect purchasing power and financial stability.

Tools Used in Hawkish Policy

Central banks rely on specific tools to implement a hawkish stance. These tools directly influence borrowing costs and market liquidity.

The most common tools include:

- Interest rate hikes

- Quantitative tightening (reducing bond holdings)

- Forward guidance signaling higher future rates

How Hawkish Policy Affects Interest Rates

Interest rates usually rise under a hawkish policy. Higher rates make loans more expensive for consumers and businesses, reducing spending and investment.

Over time, reduced demand helps slow inflation. However, it can also increase unemployment or slow economic growth if applied too aggressively.

Hawkish Impact on Forex Markets

Hawkish policy often strengthens a country’s currency. Higher interest rates attract foreign investors seeking better returns, increasing demand for that currency.

In forex trading, a hawkish central bank tone can cause sharp currency movements. Traders closely analyze speeches, statements, and meeting minutes for hawkish signals.

Hawkish Impact on Stocks and Bonds

Stock markets often react negatively to hawkish signals. Higher interest rates increase borrowing costs and reduce future profit expectations, which can pressure stock prices.

Bond markets also feel the impact, as rising rates push bond prices lower. Long-term bonds are especially sensitive to hawkish policy shifts.

Hawkish Signals Traders Watch For

Traders and investors pay close attention to subtle clues that suggest a hawkish shift. These signals often appear before actual rate changes.

Key hawkish signals include:

- Language emphasizing inflation risks

- Reduced focus on unemployment or growth

- Forecasts showing higher future rates

- Faster pace of policy tightening

Is Hawkish Policy Good or Bad?

Hawkish policy is neither inherently good nor bad. Its effectiveness depends on economic conditions and timing.

When inflation is high, a hawkish stance can protect long-term stability. When used too aggressively, it can slow growth unnecessarily and increase recession risks.

Hawkish in Simple Terms

In simple terms, hawkish means being tough on inflation. Policymakers with this mindset believe rising prices are the biggest threat to the economy.

They prefer higher interest rates and tighter controls to keep inflation in check, even if it means slower growth for a while.

Why the Term Hawkish Matters to Traders and Investors

Understanding hawkish language helps traders anticipate market moves. Central bank communication often moves markets before policy changes actually happen.

For investors, recognizing a hawkish shift can guide decisions on currencies, stocks, bonds, and risk management strategies.

Final Thoughts

Hawkish is a powerful term in economics that signals a strong anti-inflation stance. It reflects a willingness to tighten policy, raise rates, and prioritize price stability.

By understanding what hawkish means and how it affects markets, traders and investors can make more informed decisions and better interpret central bank actions.