The Evening Star is a classic bearish candlestick pattern that signals a potential trend reversal from bullish to bearish. It appears after an upward move and warns traders that buying pressure is weakening and sellers may soon take control.

This pattern is popular among forex, stock, and crypto traders because it combines a clear visual structure with strong market psychology. When understood correctly, the Evening Star can help traders anticipate trend changes instead of reacting too late.

What the Evening Star Pattern Represents

The Evening Star represents a gradual shift in market sentiment from optimism to caution and finally to bearish control. Each candle in the pattern reflects a different stage of that transition.

Rather than indicating an immediate collapse in price, the pattern suggests that momentum is slowing and the trend may be vulnerable. This makes it especially useful for traders who want early warnings rather than late confirmations.

Structure of the Evening Star Pattern

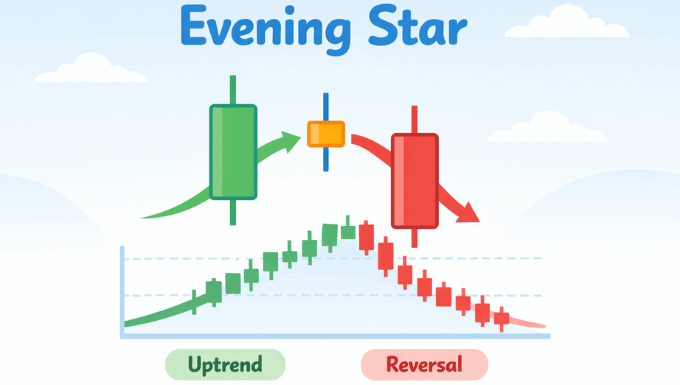

The Evening Star consists of three distinct candlesticks, each playing a specific role in the setup. Together, they form a clear visual story of trend exhaustion.

First Candle: Strong Bullish Momentum

The first candle is a large bullish candle that continues the existing uptrend. It shows strong buying interest and confidence among buyers.

This candle confirms that the market was clearly bullish before the reversal signal began forming.

Second Candle: Market Indecision

The second candle is usually small-bodied and may be bullish, bearish, or even a doji. It often gaps slightly above the first candle in stock markets, though gaps are less common in forex.

This candle reflects hesitation, showing that buyers are losing control while sellers are starting to challenge the trend.

Third Candle: Bearish Confirmation

The third candle is a strong bearish candle that closes well into the body of the first candle. This decisive move confirms that sellers have taken control.

Without this third candle, the pattern is incomplete and should not be traded as an Evening Star.

Why the Evening Star Is a Bearish Reversal Pattern

The strength of the Evening Star comes from its psychology rather than its shape alone. It shows buyers pushing price higher, then stalling, and finally being overwhelmed by sellers.

This gradual shift makes the pattern more reliable than single-candle reversal signals. It reflects a genuine change in control rather than a temporary pullback.

How to Identify a High-Quality Evening Star

Not every three-candle formation qualifies as a reliable Evening Star. Certain conditions improve its accuracy and reduce false signals.

A high-quality Evening Star usually appears:

- After a clear and extended uptrend

- Near resistance levels or previous highs

- With a strong bearish third candle

- On higher timeframes such as H1, H4, or daily charts

When these factors align, the pattern carries much more weight.

How to Trade the Evening Star Pattern

Trading the Evening Star requires patience and confirmation rather than anticipation. Entering too early often leads to unnecessary losses.

Entry Strategy

A common approach is to enter a sell trade after the third candle closes. This confirms that the bearish shift has already taken place.

Some traders wait for a small retracement toward the third candle’s midpoint to improve the entry price, especially in volatile markets.

Stop Loss Placement

The safest stop loss is placed above the high of the Evening Star pattern. This level invalidates the setup if the price moves above it.

Using tight stops inside the pattern often leads to being stopped out prematurely.

Take Profit Targets

Profit targets are typically set at:

- The nearest support level

- Previous swing lows

- Key moving averages or trendlines

Risk-to-reward should always be at least 1:2 to justify the trade.

Evening Star vs Morning Star

The Evening Star is often compared to its bullish counterpart, the Morning Star. While their structures are similar, their market implications are opposite.

The Evening Star signals a bearish reversal after an uptrend, while the Morning Star signals a bullish reversal after a downtrend. Understanding both patterns helps traders read market cycles more effectively.

Common Mistakes Traders Make With the Evening Star

Many traders misuse the Evening Star by ignoring context or rushing into trades. These mistakes reduce the pattern’s effectiveness.

Common errors include:

- Trading the pattern in a sideways market

- Ignoring trend direction

- Entering before the third candle closes

- Using the pattern without confirmation tools

Avoiding these mistakes significantly improves consistency.

Best Indicators to Combine With the Evening Star

The Evening Star works best when combined with other technical tools. Confirmation reduces false signals and improves timing.

Useful confirmations include:

- Resistance zones or supply areas

- RSI is showing overbought conditions

- Bearish divergence on momentum indicators

- Declining volume during the second candle

These tools support the bearish narrative behind the pattern.

Is the Evening Star Reliable in Forex Trading?

The Evening Star is reliable in forex when used correctly and in the right conditions. While gaps are rare in forex, the psychology behind the pattern still applies.

Higher timeframes and strong trends produce the most reliable signals. On very low timeframes, market noise can reduce accuracy.

Final Thoughts

The Evening Star is a powerful bearish reversal pattern that helps traders spot potential trend endings before major declines. Its strength lies in the story it tells about shifting market control.

When traded with patience, confirmation, and proper risk management, the Evening Star can become a valuable part of any price action trading strategy.