A dirty float is an exchange rate system in which a country allows its currency to float with market forces but occasionally intervenes to influence its value. In the first paragraph of this guide, it is important to be clear that a dirty float sits between a fully free-floating currency and a tightly controlled fixed exchange rate.

Instead of setting an official rate, the central bank steps in only when currency movements become too volatile or threaten economic stability. This makes the dirty float one of the most widely used exchange rate systems in the modern global economy.

What Is a Dirty Float?

A dirty float is best understood as a managed floating exchange rate system. Under this system, currency prices are mainly determined by supply and demand in the foreign exchange market.

At the same time, the central bank reserves the right to intervene when it feels the exchange rate is moving too fast, too far, or in an undesirable direction. These interventions are not scheduled or publicly announced in advance, which is why the system is often described as “dirty.”

Why the Term “Dirty Float” Is Used

The phrase “dirty float” may sound negative, but it does not imply wrongdoing. Instead, it reflects the idea that the currency does not float completely freely.

The “dirty” aspect refers to selective government involvement that distorts pure market pricing. Economists often use the term interchangeably with “managed float,” although “dirty float” is more informal and descriptive.

How a Dirty Float Exchange Rate System Works

A dirty float system operates through a balance of market forces and policy actions. Understanding how this balance works helps explain why many countries prefer this approach.

Role of Supply and Demand

In normal conditions, currency values move based on trade flows, capital movements, interest rates, and investor sentiment. Export demand, imports, tourism, and foreign investment all influence price movements.

These forces determine the day-to-day exchange rate without constant government control.

Role of Central Bank Intervention

Central banks step in only when market movements threaten inflation, exports, or financial stability. Intervention may include buying or selling foreign currency reserves.

The goal is not to fix the exchange rate permanently but to smooth excessive fluctuations and guide the currency toward preferred levels.

Tools Used in a Dirty Float System

Countries operating a dirty float rely on several policy tools to influence their currency when needed. Each tool has a different impact and purpose.

- Foreign exchange market intervention through direct buying or selling of currency

- Interest rate adjustments to attract or discourage capital flows

- Capital controls are used in extreme situations to limit rapid money movement

These tools are used cautiously to avoid undermining market confidence.

Dirty Float vs Free Float Exchange Rates

Comparing a dirty float with a free float highlights the trade-offs involved in currency management.

Key Differences

A free-floating currency is left entirely to market forces, with no regular intervention. In contrast, a dirty float allows limited and strategic intervention.

While free floats promote transparency, dirty floats offer policymakers flexibility to respond to shocks such as financial crises or sudden capital outflows.

Dirty Float vs Fixed Exchange Rate Systems

Dirty floats also differ sharply from fixed or pegged exchange rate regimes.

Stability vs Flexibility

Fixed systems tie a currency to another currency or basket, often requiring large reserves to maintain the peg. Dirty floats avoid this rigidity while still offering some stability.

This middle-ground approach reduces the risk of currency crises caused by unsustainable pegs.

Why Countries Choose a Dirty Float System

Many governments adopt a dirty float because it balances economic control with market efficiency. This choice is often shaped by development level, trade exposure, and financial market depth.

A dirty float allows policymakers to protect exports, manage inflation, and respond to global shocks without fully surrendering currency control.

Advantages of a Dirty Float Exchange Rate

The dirty float system offers several practical benefits when managed carefully. These advantages explain why it is so widely used.

It provides flexibility during economic stress while still allowing the currency to reflect underlying economic conditions. It also helps smooth extreme volatility that could harm businesses and consumers.

Disadvantages and Risks of Dirty Floating

Despite its benefits, a dirty float is not without drawbacks. Poorly managed intervention can create uncertainty and reduce investor confidence.

Lack of transparency may also encourage speculation if traders try to anticipate central bank actions. Overuse of intervention can weaken foreign reserves over time.

Real-World Examples of Dirty Float Currencies

Most major economies today operate under some form of dirty float. These examples show how the system works in practice.

United States Dollar (USD)

The US dollar is largely market-driven, but authorities intervene indirectly through monetary policy and rare coordinated actions. Institutions influence currency value mainly through interest rates rather than daily market intervention.

Swiss Franc (CHF)

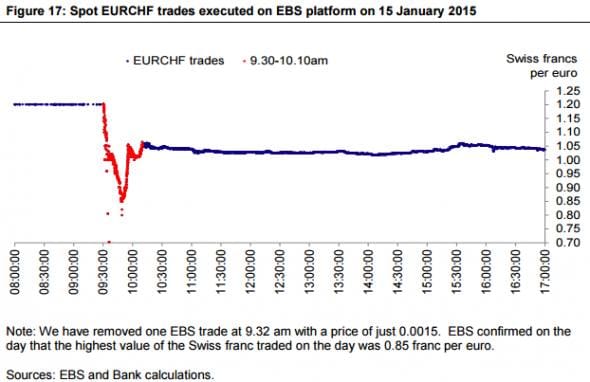

For example, the Swiss National Bank (SNB) maintained a “currency floor” of 1.20 in the EURCHF to avoid excessive appreciation of the Swiss franc against the currencies of its trade partners in the EU.

Currency appreciation of the Swiss franc would damage the competitiveness of Swiss exports.

In January 2005, after years of market operations to defend that limit, the SNB decided to abandon the 1.20 floor without prior notice, triggering a massive euro devaluation.

Japanese Yen (JPY)

Japan allows the yen to float but intervenes during periods of extreme volatility. The government has historically stepped in to prevent rapid appreciation that could hurt exports.

Indian Rupee (INR)

India operates a clear dirty float system, with the central bank intervening to smooth excessive swings. This approach helps manage inflation and maintain export competitiveness.

Dirty Float in Emerging and Developing Economies

Emerging markets often prefer dirty floats due to higher vulnerability to capital flows. Sudden inflows or outflows can destabilize local economies if left unchecked.

Institutions like the and the frequently advise managed flexibility for countries with less-developed financial markets.

How Dirty Floating Affects Forex Traders

For forex traders, dirty floats introduce both opportunity and risk. Currency prices still respond to technical and fundamental analysis, but intervention can change trends abruptly.

Traders must watch economic data, interest rate policy, and central bank signals closely when trading dirty float currencies.

Dirty Float and Currency Manipulation: Clearing the Confusion

A dirty float is not the same as currency manipulation. Occasional intervention to stabilize markets is widely accepted under international norms.

Manipulation usually refers to a persistent, one-sided intervention aimed at gaining unfair trade advantages. Most dirty float systems do not meet this definition.

Is a Dirty Float System Good or Bad?

A dirty float is neither inherently good nor bad. Its success depends on transparency, discipline, and economic fundamentals.

When used responsibly, it offers stability without sacrificing flexibility. When misused, it can distort markets and reduce trust.

Key Takeaways

A dirty float exchange rate system allows currencies to move with market forces while permitting limited government intervention. This balance makes it the most common system in today’s global economy.

Understanding dirty floats helps investors, traders, and policymakers better interpret currency movements and central bank actions in real-world markets.