A currency pair is the foundation of forex trading, and understanding it is essential before placing a single trade. In simple terms, a currency pair shows the value of one currency compared to another, telling you how much of the second currency is needed to buy one unit of the first.

When you trade forex, you are never buying or selling a currency in isolation. You are always exchanging one currency for another, and the relationship between the two is what creates price movement and trading opportunities.

What Is a Currency Pair?

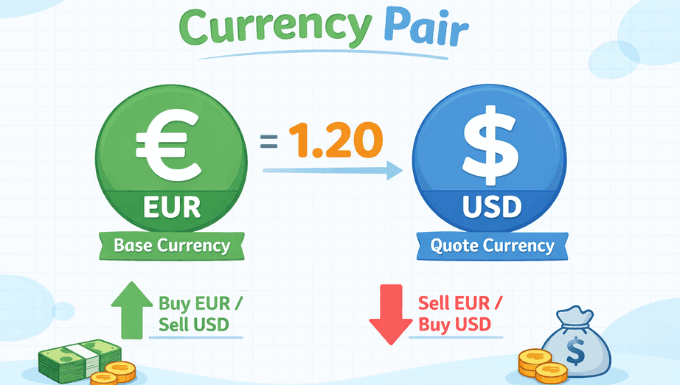

A currency pair represents two different national currencies quoted together. The first currency is the base currency, and the second is the quote currency, which shows how much it costs to buy one unit of the base.

For example, if a pair is priced at 1.2000, it means one unit of the base currency is worth 1.20 units of the quote currency. This structure allows traders to compare economic strength, interest rates, and market sentiment between two countries.

How a Currency Pair Is Structured

Every currency pair follows a fixed and consistent structure. Understanding this structure makes price quotes easier to read and trade decisions clearer.

The base currency is always listed first and remains fixed at one unit. The quote currency comes second and fluctuates based on market supply and demand.

Base Currency and Quote Currency

The base currency is what you are buying or selling. The quote currency is what you use to make the purchase.

If you buy a currency pair, you are buying the base currency and selling the quote currency. If you sell the pair, you are selling the base currency and buying the quote currency instead.

Why Currency Pairs Move in Price

Currency pair prices move because of changes in economic conditions, interest rates, political stability, and market expectations. Traders around the world react to news, data releases, and central bank decisions, which shift supply and demand.

Even small changes in sentiment can move prices, especially in highly liquid markets. This constant movement is what creates both opportunities and risks for traders.

Types of Currency Pairs

Currency pairs are grouped into categories based on liquidity, popularity, and the economies involved. These categories help traders understand volatility, spreads, and trading behavior.

Each type serves a different purpose depending on a trader’s experience level and strategy.

Major Currency Pairs

Major pairs include the most traded currencies in the world and always involve the US dollar. These pairs are known for high liquidity and relatively stable price behavior.

They are often preferred by beginners because trading costs are lower and market information is widely available.

Minor Currency Pairs

Minor pairs do not include the US dollar but still involve strong global currencies. They tend to have moderate liquidity and slightly wider spreads.

These pairs can offer unique opportunities when one economy outperforms another, but they may move differently from major pairs.

Exotic Currency Pairs

Exotic pairs combine a major currency with one from a developing or smaller economy. These pairs often experience higher volatility and wider spreads.

They are usually better suited for experienced traders who understand the risks and follow regional economic developments closely.

Understanding Bid and Ask Prices

Every currency pair is quoted with two prices: the bid and the ask. These prices reflect the cost of buying or selling at any given moment.

The bid is the price at which the market is willing to buy the base currency. The ask is the price at which the market is willing to sell it.

What the Spread Means

The spread is the difference between the bid and the ask price. It represents the cost of entering a trade and is how many brokers earn revenue.

Tighter spreads usually indicate higher liquidity and lower trading costs. Wider spreads often appear during low-volume periods or in volatile markets.

How Currency Pairs Are Quoted

Currency pairs are quoted using standardized formats to ensure consistency across platforms. Prices are typically shown with four or five decimal places, depending on the pair.

The smallest unit of price movement is called a pip. Understanding pips helps traders measure profit, loss, and risk more accurately.

Why Currency Pairs Matter in Trading

Currency pairs are not just symbols on a chart. They reflect real economic relationships between countries and regions.

By studying a currency pair, traders gain insight into interest rate differences, economic growth, and market confidence between two economies.

Choosing the Right Currency Pair to Trade

Selecting the right currency pair depends on experience, risk tolerance, and trading style. Some traders prefer stable markets, while others look for fast-moving opportunities.

Beginners often start with major pairs because they are easier to analyze and less costly to trade. As experience grows, traders may explore minors or exotics with clearer strategies.

Common Mistakes Beginners Make With Currency Pairs

Many new traders focus only on price movement without understanding what drives it. This can lead to poor timing and unnecessary losses.

Another common mistake is trading too many currency pairs at once. Focusing on a few well-understood pairs often leads to better consistency and decision-making.

Currency Pair Correlations and Relationships

Some currency pairs move in similar or opposite directions because of shared economic factors. These relationships are known as correlations.

Understanding correlations helps traders manage risk, avoid overexposure, and build more balanced trading strategies.

Currency Pairs and Risk Management

Risk management begins with understanding how a currency pair behaves. Volatility, liquidity, and average price movement all affect position sizing and stop placement.

By choosing pairs that match their risk profile, traders can reduce emotional stress and improve long-term performance.

Final Thoughts

A currency pair is the building block of the forex market, linking two economies in a constantly changing relationship. Learning how pairs work gives traders clarity, structure, and confidence.

Whether you are new to forex or refining your skills, a solid understanding of currency pairs will always remain a key advantage in trading decisions.