The Commitments of Traders Report, often shortened to COT, is a weekly publication that shows how different groups of traders are positioned in futures and options markets. In simple terms, it reveals who is buying, who is selling, and how large their positions are. Because the report reflects real positions taken by institutions and professional traders, many market participants use it to understand sentiment and potential turning points.

The COT report is published by the CFTC and covers major markets such as currencies, commodities, stock index futures, and interest rates. When used correctly, it helps traders add context to price action rather than replacing technical or fundamental analysis.

What Is the Commitments of Traders (COT) Report?

The Commitments of Traders report is a transparency tool designed to show how futures markets are positioned at a given point in time. It breaks down open interest—the total number of outstanding contracts—by trader category.

Each report reflects positions held as of Tuesday and is released publicly on Friday. This small delay means the data is not for day trading, but it remains extremely useful for swing traders, position traders, and long-term investors.

Why the COT Report Exists

The COT report exists to promote fairness and transparency in derivatives markets. By showing how large traders are positioned, the CFTC reduces the risk of hidden market manipulation.

From a trader’s perspective, the report offers insight into whether professional money is heavily biased in one direction. Extreme positioning can sometimes warn of crowded trades and potential reversals.

How the COT Report Is Structured

The COT report is divided into several formats, each serving a slightly different purpose. Understanding these formats helps you choose the one that matches your trading style.

Legacy COT Report

The legacy report is the original and simplest version. It divides traders into three broad groups and is still widely used for long-term analysis.

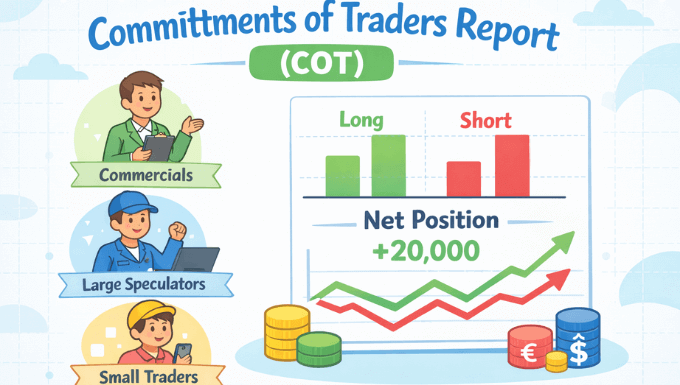

The categories in the legacy report are:

- Commercial traders

- Non-commercial traders

- Non-reportable traders

This version is popular because it clearly separates hedgers from speculators.

Disaggregated COT Report

The disaggregated report provides more detail, especially in commodity markets. It breaks commercial traders into sub-groups such as producers and swap dealers.

This format is useful if you trade commodities like gold, oil, or agricultural products and want deeper insight into hedging activity.

Traders in Financial Futures (TFF)

The TFF report focuses on financial markets such as currencies, stock indices, and Treasury futures. It offers clearer classification for institutional participants.

Forex and index traders often prefer this report because it better reflects modern financial market structures.

Who Are the Traders in the COT Report?

Each trader category in the COT report represents a different motivation and behavior. Knowing what drives each group is essential for proper interpretation.

Commercial Traders (Hedgers)

Commercial traders use futures to hedge business risk rather than to speculate. In currency futures, these may include multinational companies or financial institutions managing exposure.

Because commercials are often considered “smart money,” traders watch their extreme positions closely, especially when they move against prevailing trends.

Non-Commercial Traders (Large Speculators)

Non-commercial traders include hedge funds, commodity trading advisors, and other large speculators. Their goal is profit, not risk reduction.

These traders tend to follow trends and momentum. When their positions become heavily one-sided, markets can become vulnerable to sharp corrections.

Non-Reportable Traders (Retail and Small Traders)

Non-reportable traders are participants whose positions are too small to require reporting. This group often represents retail traders.

Historically, small traders tend to be on the wrong side at major market turning points, which is why some analysts use them as a contrarian signal.

How to Read the COT Report Step by Step

Reading the COT report becomes easier once you know what to focus on. The key is to simplify the data and avoid over-analysis.

Start by identifying the market you trade, such as EUR futures or gold futures. Then focus on net positions rather than raw long and short numbers.

Net position is calculated by subtracting short contracts from long contracts. This single number quickly shows whether a group is bullish or bearish.

Understanding Net Positions and Open Interest

Net positions show directional bias, while open interest shows participation. When both increase together, it often confirms a strong trend.

If prices rise while non-commercial net longs increase, it suggests trend-following behavior. If prices rise but net longs fall, it may signal weakening conviction.

Interpreting Extremes in COT Data

COT data is most powerful at extremes. When positioning reaches historical highs or lows, markets often struggle to continue in the same direction.

An extreme does not mean an immediate reversal. Instead, it signals increased risk and the need for confirmation from price action or fundamentals.

Using the COT Report in Forex Trading

In forex, the COT report is based on currency futures rather than spot markets. While not identical, futures positioning often reflects broader institutional sentiment.

Forex traders commonly track major currencies such as EUR, GBP, JPY, and USD. Changes in non-commercial positions can help confirm or question existing trends.

Using the COT Report in Commodity Trading

Commodity traders use the COT report to understand producer hedging and speculative demand. This is especially useful in gold, oil, and agricultural markets.

When producers aggressively hedge at high prices, it can signal limited upside. When hedging declines near lows, it may hint at undervaluation.

Combining the COT Report with Technical Analysis

The COT report works best when combined with charts. It adds a positioning layer that pure technical analysis cannot provide.

For example, a bullish chart pattern supported by increasing non-commercial longs is more convincing than a pattern formed against declining participation.

Common Mistakes Traders Make with the COT Report

Many traders misuse the COT report by expecting precise entry signals. This leads to frustration and poor timing.

The most common mistakes include:

- Treating COT data as a short-term trading signal

- Ignoring historical context

- Using raw numbers instead of net positions

The report is a strategic tool, not a trigger.

Advantages of Using the COT Report

The COT report offers insight that price alone cannot provide. It shows how major players are positioned behind the scenes.

Its main advantages include improved sentiment analysis, better risk awareness, and stronger confirmation for long-term trades.

Limitations of the COT Report

Despite its value, the COT report has clear limitations. The reporting delay means data is always slightly outdated.

It also reflects futures markets only, which may not perfectly match spot markets. Traders should treat it as contextual information rather than a standalone system.

Best Practices for Using the COT Report Effectively

Effective use of the COT report requires consistency and patience. Tracking changes over time is more important than reacting to single reports.

Focus on trends in positioning, compare current levels with historical ranges, and always confirm signals with price action.

Final Thoughts on the Commitments of Traders Report

The Commitments of Traders report is one of the most transparent windows into professional market positioning. When used with discipline, it helps traders understand sentiment, manage risk, and avoid crowded trades.

Rather than trying to predict exact market turns, use the COT report to build context. Over time, this broader perspective can significantly improve trading decisions and confidence.