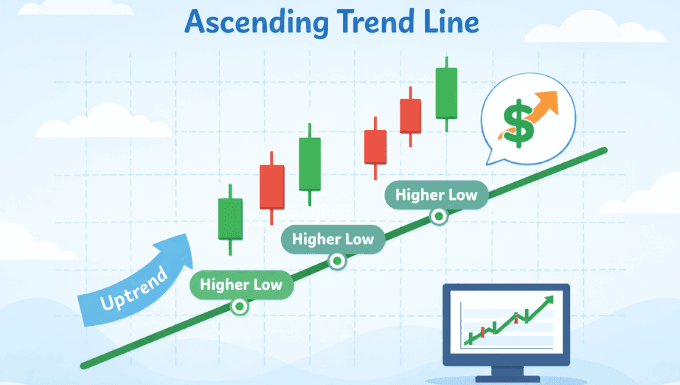

An ascending trend line is one of the most important tools in technical analysis because it visually shows an uptrend on a price chart. It connects a series of higher lows and helps traders understand the direction, strength, and structure of a rising market.

In simple terms, an ascending trend line acts as a rising support level. As long as the price respects this line, buyers remain in control, and the uptrend is considered healthy.

What Is an Ascending Trend Line?

An ascending trend line represents a market that is making progress upward over time. It is drawn by connecting at least two significantly higher lows, with the line sloping upward from left to right.

This line reflects buying pressure. Each time the price pulls back and finds support at a higher level than before, it confirms that buyers are willing to step in earlier than they did previously.

Why Ascending Trend Lines Matter in Trading

Ascending trend lines matter because they bring structure to what may otherwise look like random price movement. They help traders make sense of trends and avoid trading against market direction.

When used correctly, they support better decision-making by highlighting areas where price is likely to react. This allows traders to plan entries, exits, and risk more clearly instead of guessing.

How to Draw an Ascending Trend Line Correctly

Drawing an ascending trend line correctly starts with identifying the right swing points. Accuracy matters more than forcing the line to fit your bias.

Step 1: Identify Higher Lows

Begin by spotting at least two clear swing lows where the price moved down and then continued higher. These lows should be visually obvious and not minor price noise.

The more times price forms a higher low, the stronger and more reliable the trend line becomes.

Step 2: Connect the Lows with a Straight Line

Draw a straight line that connects the selected higher lows. Extend the line forward to the right so it can act as future support.

The line should touch price naturally. If it cuts through many candles, the swing points chosen are likely incorrect.

Step 3: Validate with Multiple Touches

A valid ascending trend line is confirmed when the price respects it at least three times. Each clean reaction strengthens its importance.

More touches mean more traders are watching the same level, increasing the chance of future reactions.

Ascending Trend Line vs Descending and Horizontal Lines

Understanding the difference between trend lines helps avoid confusion when market conditions change. Each type reflects a different market behavior.

An ascending trend line shows higher lows and bullish momentum. A descending trend line shows lower highs and bearish pressure, while a horizontal line signals consolidation or a range-bound market.

How Traders Use Ascending Trend Lines

Traders use ascending trend lines as practical tools rather than decorative lines. They serve as guides for trading decisions across multiple strategies.

Trend Confirmation

When the price consistently stays above an ascending trend line, the uptrend remains intact. This helps traders stay aligned with bullish momentum instead of fighting it.

A clean break below the line may signal that the trend is weakening or changing.

Support and Bounce Trades

Many traders look for buying opportunities near the trend line. When price pulls back into the line and shows rejection, it often signals a potential continuation move.

These trades work best when combined with clear price action signals rather than relying on the line alone.

Stop-Loss Placement

Ascending trend lines provide logical areas for risk management. Stops are often placed slightly below the line to protect against deeper reversals.

This approach keeps risk defined and avoids emotional decision-making.

Ascending Trend Line Breakouts and What They Mean

A breakout occurs when the price closes decisively below an ascending trend line. This does not always mean an immediate reversal, but it does signal a shift in market behavior.

Some breakouts lead to trend reversals, while others result in temporary pullbacks. Confirmation from price structure and volume improves reliability.

Common Mistakes When Using Ascending Trend Lines

Many traders misuse trend lines, leading to poor decisions. Awareness of common mistakes helps improve accuracy and confidence.

One common error is forcing a trend line to fit the price instead of letting the price define the line. Another is drawing lines using insignificant price swings, which reduces reliability.

Ignoring market context is also risky. Ascending trend lines work best in trending markets, not in choppy or sideways conditions.

Best Timeframes for Ascending Trend Lines

Ascending trend lines can be used on any timeframe, but reliability increases on higher timeframes. Daily and four-hour charts often provide clearer structure and fewer false signals.

Lower timeframes can still be effective, especially for intraday trading, but they require stricter confirmation and disciplined risk control.

Combining Ascending Trend Lines with Other Tools

Ascending trend lines become more powerful when used alongside complementary tools. This reduces false signals and improves trade quality.

Common confirmations include support and resistance zones, candlestick patterns, and momentum indicators. The goal is alignment, not complexity.

Real-World Example of an Ascending Trend Line

In a strong uptrend, price rallies, pulls back, and then continues higher multiple times. Each pullback stops at a higher level, forming clear higher lows.

By connecting those lows, the ascending trend line becomes visible. As long as the price respects it, traders treat the trend as bullish and focus on buying opportunities.

Are Ascending Trend Lines Always Reliable?

Ascending trend lines are reliable, but they are not guarantees. Markets are influenced by news, liquidity, and sentiment, which can override technical structures.

The key is to treat the trend line as a guide rather than a rule. Risk management and confirmation always come first.

Final Thoughts

An ascending trend line is a simple yet powerful way to understand bullish market structure. It helps traders see trends clearly, plan trades logically, and manage risk with discipline.

When drawn correctly and used with patience, ascending trend lines can become a foundational tool in any trading approach, from beginner strategies to advanced technical analysis.