The Average Directional Index (ADX) is a technical indicator that measures the strength of a market trend, not its direction. Traders use it to judge whether a market is trending strongly, trending weakly, or moving sideways, which helps them decide when trend-following strategies are likely to work. Because ADX focuses on strength rather than direction, it pairs well with many other indicators and trading styles.

At its core, ADX answers a simple but important question: Is the market trending enough to justify a trend-based trade? This makes it especially valuable for traders who want to avoid entering positions during choppy, range-bound conditions.

What the Average Directional Index Measures

The purpose of ADX is to quantify trend strength in a consistent and objective way. It does not tell you whether to buy or sell, but it tells you whether the market is worth trading with a trend strategy.

ADX is part of the Directional Movement System developed by J. Welles Wilder. It works alongside two related lines that reflect bullish and bearish pressure, creating a framework that helps traders read market structure more clearly.

The Three Components of ADX

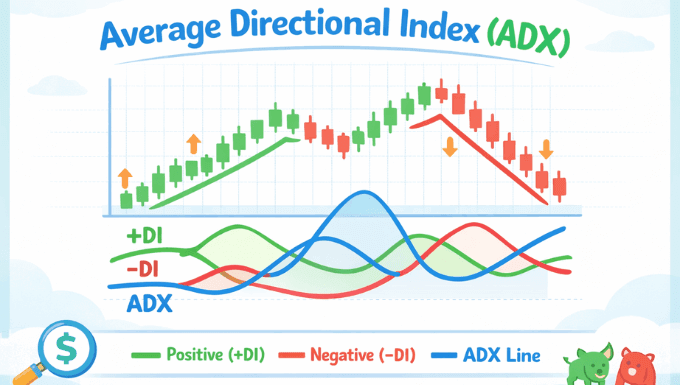

Understanding ADX starts with understanding its three lines. Each line plays a specific role in interpreting market behavior.

ADX Line (Trend Strength)

The ADX line itself measures how strong a trend is, regardless of whether the price is moving up or down. It typically ranges from 0 to 100, though values above 60 are rare in most markets.

A rising ADX means trend strength is increasing, while a falling ADX suggests the trend is weakening. The direction of the price does not matter for this line—only the intensity of movement does.

+DI (Positive Directional Indicator)

The +DI line reflects bullish pressure in the market. When +DI is above -DI, buyers are generally in control.

This line helps traders identify when upward movement is dominating, especially when combined with a strong ADX reading.

-DI (Negative Directional Indicator)

The -DI line represents bearish pressure. When -DI is above +DI, sellers are exerting more influence.

Used together with ADX, this line helps confirm whether downward moves are supported by strong momentum.

How the Average Directional Index Works

ADX is calculated using price highs, lows, and closes over a fixed period, most commonly 14 periods. While the math behind it is complex, the interpretation is straightforward once you understand the thresholds.

The indicator smooths price movement to filter out noise and focus on sustained directional movement. This makes it particularly useful for identifying when markets shift from consolidation into trending phases.

Interpreting ADX Values

ADX values are best understood in ranges rather than exact numbers. Each range provides insight into the market environment.

- Below 20: Weak or no trend; the market is likely ranging

- 20 to 25: A trend may be forming, but strength is still limited

- 25 to 40: Strong and healthy trend conditions

- Above 40: Very strong trend, often near mature or extended moves

These levels help traders avoid forcing trades in low-quality conditions. A trend-following strategy is usually more reliable once ADX moves above 25.

Using ADX in Real Trading

ADX becomes powerful when applied with clear intent. It is most effective as a filter rather than a standalone trading signal.

Identifying Trend vs Range Markets

One of the most practical uses of ADX is separating trending markets from ranging ones. When ADX stays below 20, breakout failures and false signals are more common.

When ADX rises above 25, trend-following tools such as moving averages or pullback strategies tend to perform better.

Confirming Breakouts

ADX can help confirm whether a breakout has real momentum behind it. A price breakout followed by a rising ADX suggests increasing participation and commitment from traders.

If price breaks out but ADX remains flat or low, the move may lack strength and be vulnerable to reversal.

Timing Trend Continuation Trades

ADX does not peak at the start of a trend. It often rises as the trend develops, which means strong ADX readings can support continuation trades rather than early entries.

A rising ADX combined with clear higher highs or lower lows often signals that the trend still has energy.

Common ADX Trading Strategies

ADX works best when combined with simple, well-defined strategies. The goal is clarity, not complexity.

ADX with Directional Indicators

Many traders look for +DI crossing above -DI with ADX above 25 as confirmation of bullish trend conditions. The opposite applies to bearish setups.

This approach helps align direction and strength, reducing the chance of trading against weak momentum.

ADX with Moving Averages

Moving averages show direction, while ADX shows strength. When the price is above a rising moving average, and ADX is increasing, the trend has structural support.

This combination is popular because it avoids overloading the chart with conflicting signals.

Strengths of the Average Directional Index

ADX has earned its popularity because it solves a common trading problem: knowing when not to trade.

It adapts well across markets and timeframes, works in forex, stocks, and commodities, and remains effective decades after its creation. Most importantly, it encourages discipline by keeping traders out of low-quality setups.

Limitations and Mistakes to Avoid

Like all indicators, ADX has limits that traders must respect. Misunderstanding these limits often leads to frustration.

ADX does not predict direction, so using it alone to buy or sell is a common mistake. It also reacts to price, meaning it can lag during sudden reversals or sharp news-driven moves.

Over-relying on exact numeric levels instead of the overall context can also reduce its effectiveness. ADX works best when interpreted alongside price structure and market conditions.

Best Settings and Timeframes for ADX

The default 14-period setting is widely used because it balances responsiveness and stability. Shorter settings react faster but may introduce noise, while longer settings smooth signals but react more slowly.

ADX works on all timeframes, from intraday charts to weekly charts. Higher timeframes tend to produce more reliable readings, while lower timeframes benefit from additional confirmation.

Who Should Use the Average Directional Index

ADX is suitable for beginners and experienced traders alike. Beginners benefit from its clear guidance on market conditions, while advanced traders use it to refine timing and improve trade selection.

If your strategy depends on trends, ADX can help you trade less and trade better by focusing only on markets that are moving with purpose.

Final Thoughts

The Average Directional Index remains one of the most practical tools in technical analysis because it focuses on what matters most: trend strength. It does not promise perfect entries or exits, but it helps traders align their strategies with the right market environment.

Used patiently and combined with sound risk management, ADX can become a reliable guide that improves consistency and decision-making across many types of markets.