Dark Cloud Cover is a well-known bearish candlestick pattern used in technical analysis to identify potential trend reversals in financial markets. It often appears after an uptrend and warns traders that buying pressure may be weakening while sellers are starting to take control.

This pattern is widely used in forex, stocks, indices, and cryptocurrencies because it visually captures a shift in market sentiment. When understood correctly and combined with confirmation tools, Dark Cloud Cover can help traders make more disciplined and informed trading decisions.

What Is the Dark Cloud Cover Candlestick Pattern?

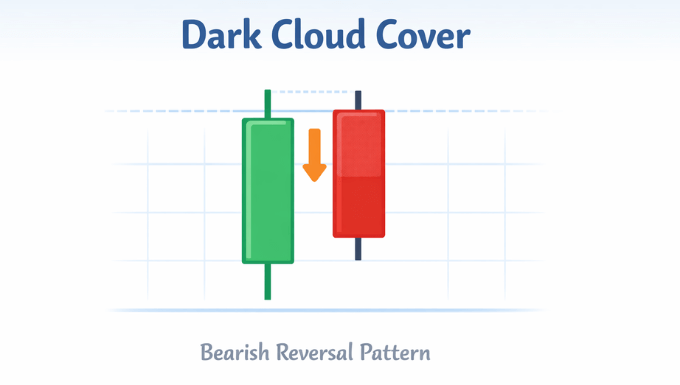

Dark Cloud Cover is a two-candlestick reversal pattern that forms at the top of an uptrend. It represents a sudden change in control from buyers to sellers within a short period.

The pattern begins with a strong bullish candle, followed by a bearish candle that opens above the previous close but closes deep into the body of the first candle. This sharp rejection of higher prices is what gives the pattern its name and its bearish implication.

Key Characteristics of Dark Cloud Cover

Understanding the structure of Dark Cloud Cover is essential before attempting to trade it. Each component of the pattern plays a specific role in signaling a possible reversal.

- The first candle is bullish and closes near its high, confirming strong buying pressure.

- The second candle opens above the first candle’s close, suggesting initial bullish continuation.

- The second candle closes below the midpoint of the first candle’s body, showing aggressive selling.

- The pattern forms after a clear upward trend.

These characteristics together suggest that buyers are losing momentum and sellers are beginning to dominate.

How Dark Cloud Cover Forms in the Market

Dark Cloud Cover forms due to a shift in trader psychology rather than random price movement. At the start, optimism remains strong as prices gap higher, encouraging late buyers to enter the market.

As selling pressure increases during the same session, those buyers become trapped, leading to a strong bearish close. This sudden reversal often triggers profit-taking, stop-loss orders, and fresh short positions, reinforcing downward momentum.

Why Dark Cloud Cover Is Considered Bearish

The bearish nature of Dark Cloud Cover comes from how decisively the price rejects higher levels. Buyers attempt to push the market upward, but sellers overwhelm them before the session ends.

Closing below the midpoint of the prior bullish candle is critical because it signals that more than half of the previous gains have been erased. This loss of control often marks the beginning of a pullback or a full trend reversal.

Dark Cloud Cover vs Similar Candlestick Patterns

Dark Cloud Cover is often confused with other bearish reversal patterns, but the differences matter. Each pattern reflects a slightly different market dynamic.

Dark Cloud Cover should not be mistaken for Bearish Engulfing, which fully engulfs the previous candle. It is also different from Evening Star, which uses three candles and includes a pause in momentum. Recognizing these distinctions helps traders avoid misinterpretation.

Best Market Conditions for Dark Cloud Cover

Dark Cloud Cover works best when it appears in specific market environments. Context is just as important as the pattern itself.

This pattern is most reliable when it forms after a prolonged uptrend, near resistance levels, or around psychologically important price zones. It tends to be less effective in sideways or low-volatility markets where reversals lack follow-through.

How to Trade the Dark Cloud Cover Pattern

Trading Dark Cloud Cover requires patience and confirmation rather than immediate execution. The pattern alone suggests a potential reversal, not a guaranteed one.

Many traders wait for the next candle to close bearish before entering a short position. Stop-loss orders are often placed above the high of the second candle, while profit targets may be set near support levels or using risk-to-reward ratios.

Using Confirmation Tools with Dark Cloud Cover

Confirmation tools help filter false signals and improve trade accuracy. They add context and reduce emotional decision-making.

Common confirmation tools include trendlines, moving averages, momentum indicators, and key support and resistance levels. When Dark Cloud Cover aligns with overbought conditions or bearish divergence, its reliability improves significantly.

Common Mistakes Traders Make with Dark Cloud Cover

Many traders misuse Dark Cloud Cover by focusing only on the pattern’s appearance. This often leads to poor trade entries and unnecessary losses.

A common mistake is ignoring the broader trend or trading the pattern in consolidation zones. Another frequent error is entering trades without confirmation or using overly tight stop-loss levels that do not respect market structure.

Advantages and Limitations of Dark Cloud Cover

Dark Cloud Cover offers several benefits, but it also has limitations that traders should understand. Balanced expectations lead to better long-term results.

One advantage is its clarity and ease of identification, even for beginners. However, its limitation lies in false signals during choppy markets, which is why confirmation and proper risk management are essential.

Dark Cloud Cover in Forex and Other Markets

Dark Cloud Cover is especially popular in forex trading because currency markets frequently respect candlestick psychology. The pattern works well on higher timeframes such as H4, daily, and weekly charts.

It is equally applicable in stocks, indices, and cryptocurrencies, provided there is sufficient liquidity and a clear trend. The underlying principle remains the same across all markets: a shift from bullish to bearish sentiment.

Risk Management When Trading Dark Cloud Cover

Risk management is the foundation of successful trading, regardless of the pattern used. Dark Cloud Cover is no exception.

Traders should always define risk before entering a trade and avoid risking more than a small percentage of their account per position. Using proper position sizing and realistic profit targets helps maintain consistency over time.

Example of Dark Cloud Cover on a Price Chart

A typical Dark Cloud Cover example shows a strong bullish candle followed by a bearish candle that closes deep into the previous body. This visual structure makes it easier to spot potential reversals when scanning charts.

Seeing the pattern repeatedly across different markets helps traders build confidence and pattern recognition skills. Over time, this familiarity improves execution and discipline.

Is Dark Cloud Cover Suitable for Beginners?

Dark Cloud Cover is suitable for beginners because of its simple structure and clear bearish message. It does not require advanced indicators or complex calculations to identify.

However, beginners should practice using the pattern in demo accounts and focus on confirmation rather than prediction. Learning patience and discipline early makes the pattern far more effective.

Final Thoughts on Dark Cloud Cover

Dark Cloud Cover is a powerful candlestick pattern that highlights a potential shift from bullish to bearish market control. When used with proper context, confirmation, and risk management, it can become a valuable part of any technical trader’s toolkit.

Rather than relying on the pattern in isolation, traders should view Dark Cloud Cover as a warning signal. Respecting market structure and maintaining disciplined execution is what ultimately turns this pattern into a consistent trading edge.

Vincent Nyagaka has been trading and analyzing markets for over 10+ years. He is a respected trader, author, and coach in financial markets, and is known as the authority on price action trading. At Eazypips, he shares practical strategies and trading lessons to guide aspiring traders toward consistent results.