Understanding the Asian session forex time in Kenya is essential for traders who want to trade calmly, manage risk better, and align their strategies with market behavior. This session sets the tone for the global trading day and offers unique opportunities, especially for traders who prefer low volatility and structured price action.

The Asian session is often overlooked by beginners who focus only on London or New York. However, when used correctly, it can be a powerful time window for planning, range trading, and early market positioning.

What the Asian Forex Session Is

The Asian forex session refers to the period when major Asian financial markets are open and actively trading currencies. It marks the first major session of the global forex trading day.

This session begins the daily price discovery process. Institutional traders, banks, and exporters in Asia place orders that often shape early market direction.

Asian Session Forex Time in Kenya

For traders based in Kenya, timing is straightforward because Kenya uses East Africa Time (EAT), which is GMT+3.

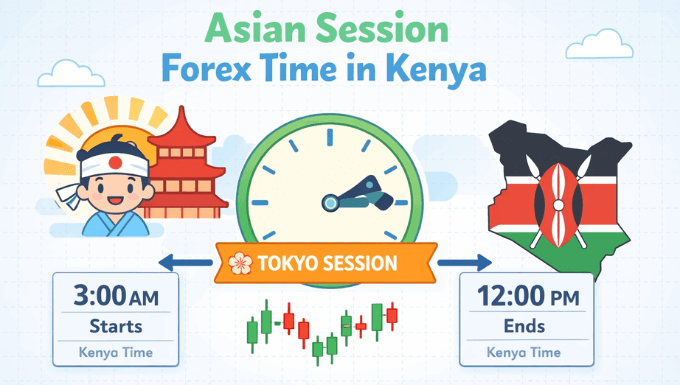

The Asian session forex time in Kenya runs from:

- 02:00 AM to 11:00 AM EAT

This timeframe includes activity from key Asian markets such as Tokyo, Sydney, Hong Kong, and Singapore. The most influential hours are typically from 03:00 AM to 09:00 AM EAT, when Tokyo is fully active.

Major Markets Active During the Asian Session

The Asian session is driven by several important financial centers. Each plays a specific role in currency movement.

Tokyo is the most dominant market during this session. Japan’s economy and the Japanese yen heavily influence price action, especially in yen-related pairs.

Sydney opens earlier and brings activity in the Australian and New Zealand dollars. Hong Kong and Singapore add liquidity later in the session, particularly in regional currency flows.

Currency Pairs That Move Most in the Asian Session

Not all currency pairs behave the same during Asian hours. Price movement is usually concentrated in pairs linked to Asian economies.

Commonly active pairs include:

- USD/JPY

- AUD/USD

- NZD/USD

- AUD/JPY

- NZD/JPY

These pairs tend to show cleaner price action during Asian hours compared to European or American pairs.

Volatility and Market Behavior in the Asian Session

The Asian session is known for lower volatility compared to London and New York. Price movements are often slower and more controlled.

This environment suits traders who prefer patience and precision. Large sudden spikes are less common, making risk management easier for beginners.

Advantages of Trading the Asian Session in Kenya

Trading during Asian hours offers several practical benefits for Kenyan traders.

First, spreads are usually stable, especially on yen and Australian dollar pairs. This makes trade costs more predictable.

Second, the market often respects support and resistance levels. This behavior is ideal for traders who rely on technical analysis and range-based strategies.

Disadvantages and Limitations to Consider

Despite its advantages, the Asian session is not ideal for every trading style.

Lower volatility means fewer large price moves. Traders who rely on fast momentum or breakout strategies may find limited opportunities.

Liquidity can also be thin outside major Asian pairs. Trading European-focused pairs during this session often leads to slow or choppy price action.

Best Trading Strategies for the Asian Session

A successful Asian session strategy focuses on structure rather than speed. Traders who understand this often achieve more consistent results.

Range trading works well because the price tends to move between clearly defined highs and lows. Identifying support and resistance on higher timeframes improves accuracy.

Breakout preparation is another effective approach. Many traders use the Asian session range to anticipate London session breakouts later in the day.

Risk Management During Asian Trading Hours

Risk management is especially important when volatility is low. Tight spreads do not eliminate risk, and poor planning can still lead to losses.

Using smaller position sizes helps account for slow-moving markets. Stop-loss levels should be placed logically, not too tight, to avoid unnecessary exits.

How the Asian Session Affects the London Session

The Asian session often creates price ranges that the London session later reacts to. Highs and lows formed during Asian hours frequently become key reference levels.

London traders watch these levels closely. Breaks above or below the Asian range often lead to strong directional moves.

Is the Asian Session Suitable for Beginners in Kenya?

For beginners, the Asian session can be an excellent learning environment. The slower pace allows traders to observe price behavior without emotional pressure.

It encourages discipline, planning, and patience. These qualities are essential for long-term success in forex trading.

Common Mistakes Kenyan Traders Make During the Asian Session

One common mistake is expecting large price movements. This often leads to overtrading and frustration.

Another issue is trading the wrong currency pairs. Focusing on European pairs during Asian hours usually results in poor setups and wasted time.

Practical Tips for Trading the Asian Session Successfully

Preparation makes a major difference during Asian trading hours.

Always mark the Asian session high and low on your chart. These levels provide valuable context for both Asian and later sessions.

Stick to one or two currency pairs. This improves focus and helps you understand how those pairs behave during low-volatility conditions.

Final Thoughts

The Asian session forex time in Kenya offers a calm, structured trading environment that many traders underestimate. While it may not deliver dramatic price moves, it provides clarity, consistency, and strong technical respect.

For traders who value patience, planning, and disciplined execution, the Asian session can become a reliable part of a well-rounded forex trading routine.

Vincent Nyagaka has been trading and analyzing markets for over 10+ years. He is a respected trader, author, and coach in financial markets, and is known as the authority on price action trading. At Eazypips, he shares practical strategies and trading lessons to guide aspiring traders toward consistent results.