Every day, thousands dive into forex trading lured by dreams of fast wealth. They open accounts with hopes of doubling their money overnight — only to find themselves wiped out within months. The statistics are sobering:

- 96% of retail forex traders lose money.

- Only 4% manage to sustain profitability and build lasting success.

Why is the failure rate so high? The answer lies in unrealistic expectations, lack of preparation, and psychological traps. If you want to survive and thrive in this competitive market, you must understand what causes most traders to fail and how to steer clear of these pitfalls.

Forex Trading Is a Profession, Not a Lottery

Many newcomers view forex like a shortcut to riches. They think learning for a few days, funding a $200 account, and starting to cash out is realistic. This mindset couldn’t be more dangerous.

Think about it:

- It takes 3 to 5 years to complete a professional degree in fields like medicine, law, or engineering.

- Even then, only a fraction land high-paying jobs. For example, in Kenya, just 1% of workers earn above Ksh.100,000 monthly, while 93% make less than Ksh.40,000, despite years of study.

Yet people believe they can master forex in a week? They ask, “How much will I make monthly if I start with $100?” — without even knowing what a pip is.

The truth: forex is a serious profession that requires rigorous study, practice, and psychological conditioning.

Why Most Forex Traders Lose Money

Below are the most common reasons why the vast majority of traders end up losing their capital.

1. Unrealistic Expectations and Quick-Rich Mentality

- Many traders expect to turn a tiny account into a fortune within weeks.

- They underestimate the complexity of the market and the time required to build skills.

- This leads to frustration, reckless trading, and eventually blown accounts.

2. Lack of a Clear, Tested Trading Strategy

Most traders don’t stick to one system. They:

- Try a method, lose a few trades, and abandon it.

- Jump to the next “holy grail” they see on YouTube or forums.

- Repeat this cycle endlessly without ever mastering a single approach.

How to fix it:

- Choose one strategy that makes sense to you.

- Backtest it over historical data.

- Demo trade until you’re confident.

- Stick to it, refine it — and avoid chasing new shiny strategies.

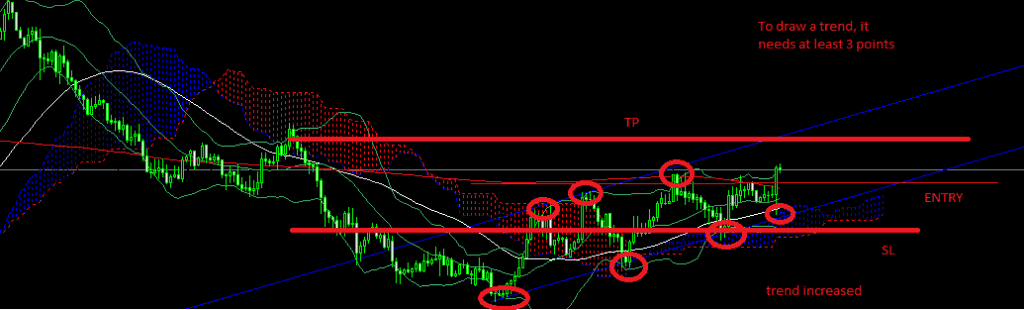

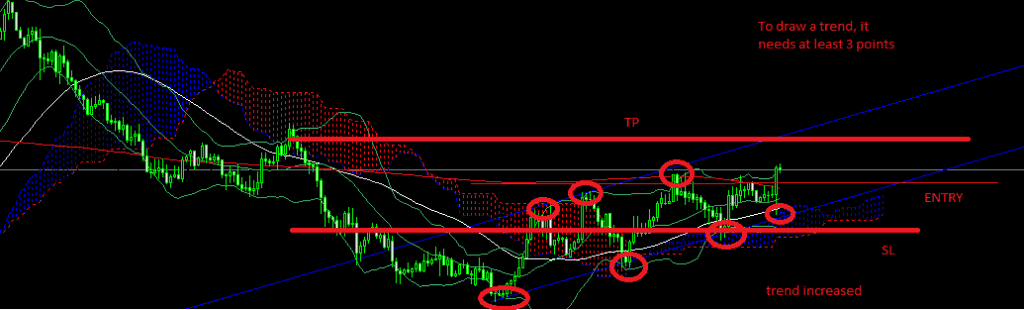

3. Poor Risk Management (Ignoring SL and TP)

Too many traders:

- Enter trades without setting Stop Loss (SL) or Take Profit (TP) levels.

- Believe they’re “so sure” they’re right that stops aren’t needed.

When the market moves against them, losses balloon quickly. Proper risk management is non-negotiable.

What you should do:

- Always define entry, SL, and TP before placing a trade.

- Place your SL at logical support/resistance levels.

- Accept small losses as the cost of doing business.

4. Overtrading and Overleveraging

- Many think more trades mean more profit.

- Or they open huge lot sizes relative to their account, hoping to “fast-track” gains.

This is a recipe for disaster. A single sharp move can wipe out your account due to leverage.

Tip:

- Risk no more than 1-2% of your account per trade.

- Quality trades matter more than quantity.

5. Greed and Fear — The Emotional Traps

Greed

- Early luck may double an account, making traders believe forex is easy.

- They start risking large positions, driven by visions of wealth.

- Eventually, an inevitable loss wipes them out.

Fear

- They place trades with SL and TP but panic when price moves against them.

- They close at a loss, only to see the market reverse and hit their original TP.

- Or they read conflicting online signals and exit trades prematurely.

Solution:

- Trust your plan.

- Understand that losses are normal — it’s your long-term edge that matters.

6. Refusing to Accept Losses

Some traders:

- Remove their stop loss hoping the market will turn around.

- Or add to losing positions (“averaging down”), digging a deeper hole.

This rarely ends well. Losses are part of trading. Accept them, learn from them, and move on.

7. Impatience and Lack of Discipline

Two factors separate successful traders from losers:

- Patience: Waiting for high-probability setups.

- Discipline: Following your plan, even if that means not trading for days.

Most traders fail because they constantly chase trades or tweak systems after a few losses, instead of allowing probabilities to play out over time.

Forex Is Not Gambling — It Has Patterns

Unlike random gambling, the forex market follows patterns shaped by large institutional players. It takes roughly 10,000 lots to move the market by a single pip, a scale retail traders cannot influence.

Big players leave footprints in price. By learning to recognize these patterns, you can “piggyback” on their moves instead of blindly guessing.

Remember:

- Professional traders don’t trade every hour or even every day.

- They wait patiently for setups aligned with institutional strategies.

How to Join the 4% Who Make Money

Want to be part of the minority who consistently profit? Here’s how:

- ✅ Invest in your education. Read reputable books, study market structure, and learn from seasoned mentors.

- ✅ Build a solid trading plan. Include entry criteria, risk rules, and psychological guidelines.

- ✅ Demo trade extensively. Treat it like live trading until mistakes become rare.

- ✅ Manage your risk. Never risk more than you’re willing to lose.

- ✅ Control your emotions. Greed and fear destroy more accounts than bad strategies.

- ✅ Keep a trading journal. Review your trades, spot patterns in your mistakes, and improve.

Final Thoughts

Forex isn’t easy money. It’s a serious profession that requires the same dedication as medicine, engineering, or law. If you approach it with discipline, patience, and a commitment to continual learning, you stand a real chance of joining the 4% who consistently extract profits from the markets.

Always remember:

- The market doesn’t pay you for activity.

- It pays you for accuracy, discipline, and patience.

Respect the process, protect your capital, and give yourself the time to truly master the craft. That’s how real trading success is built.

Vincent Nyagaka has been trading and analyzing markets for over 10+ years. He is a respected trader, author, and coach in financial markets, and is known as the authority on price action trading. At Eazypips, he shares practical strategies and trading lessons to guide aspiring traders toward consistent results.