A take-profit order is a trading instruction that automatically closes a position once the price reaches a predefined profit level. It helps traders secure gains without needing to watch the market constantly. From beginners placing their first trade to experienced traders managing risk across multiple positions, take-profit orders are a core part of disciplined trading.

In its simplest form, a take profit order answers one important question before you enter a trade: At what price am I satisfied with my profit? By deciding this in advance, you reduce emotional decision-making and bring structure to your trading approach.

What Is a Take Profit Order?

A take-profit order is a preset exit level that takes profit from the trade automatically when the market moves in your favor. It works in the background, even if you are offline or asleep.

When the price reaches the take profit level, the trading platform sends an order to close your position at or near that price. This makes it a practical tool for traders who want consistency and protection against sudden market reversals.

How a Take Profit Order Works in Practice

To understand how a take-profit order works, it helps to look at a simple trade example. The process is straightforward and built into most trading platforms.

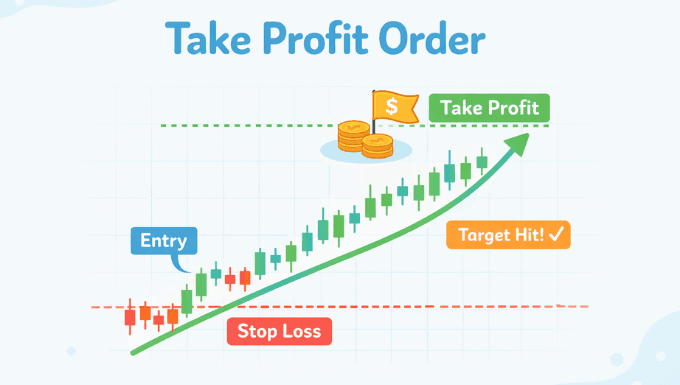

If you open a buy trade at a lower price, your take profit is placed above the entry price. If you open a sell trade at a higher price, your take profit is placed below the entry price. Once the market touches that level, the trade is closed, and the profit is realized.

Take Profit Order vs Stop Loss Order

Take profit and stop loss orders are often used together, but they serve different purposes. Understanding the difference helps you manage both profit and risk in a balanced way.

A take-profit order focuses on locking in gains, while a stop-loss order limits potential losses. Together, they define the full outcome range of a trade before it even begins.

Why Take Profit Orders Matter in Trading

Take profit orders play a key role in maintaining discipline and consistency. They reduce the temptation to hold trades too long or exit too early due to fear or greed.

Markets can reverse quickly, even after moving strongly in your favor. A take-profit order helps ensure that unrealized profits do not disappear during sudden pullbacks or news-driven volatility.

Common Types of Take Profit Orders

Different trading styles use take profit orders in slightly different ways. Each type is designed to suit specific market conditions and trader preferences.

Fixed Take Profit Order

A fixed take-profit order closes the trade at a specific price level. This level is usually chosen based on technical analysis, such as support and resistance or chart patterns.

This approach works well for traders who prefer clear targets and structured trade planning.

Partial Take Profit Order

A partial take profit order closes part of a position at one profit level while leaving the rest open. This allows traders to secure some profit while still benefiting from further price movement.

It is commonly used by traders who want flexibility without fully exiting a strong trend.

Trailing Take Profit (Dynamic Exit)

A trailing take profit adjusts as the market moves in your favor. Instead of a fixed price, it follows the price at a set distance.

This method is useful in trending markets, where traders want to stay in profitable trades as long as momentum remains strong.

How to Set a Take Profit Order Correctly

Setting a take-profit order requires more than guessing a number. It should be based on logic, market structure, and your overall trading plan.

Most traders use technical levels, such as previous highs, lows, or key price zones. Others base take profit levels on a predefined risk-to-reward ratio, such as aiming to make twice what they risk on each trade.

Take Profit Order Examples

Examples make the concept clearer and easier to apply in real trading situations.

In a buy trade, a trader enters at 1.2000 and sets a take profit at 1.2100. When the price reaches 1.2100, the platform automatically closes the trade with a profit.

In a sell trade, a trader enters at 1.3500 and sets a take profit at 1.3400. When the price falls to that level, the position closes, and the profit is secured.

Risk-to-Reward and Take Profit Placement

A take-profit order works best when paired with a clear risk-to-reward plan. This means comparing how much you are willing to lose versus how much you aim to gain.

For example, if your stop loss risks 50 pips, a take profit of 100 pips creates a 1:2 risk-to-reward ratio. Over time, this approach can improve consistency, even if not every trade is a winner.

Psychological Benefits of Using Take Profit Orders

Trading decisions are often influenced by emotions, especially during fast market movements. A take-profit order removes much of that pressure.

By deciding your exit level in advance, you avoid the stress of watching every price fluctuation. This helps maintain confidence and prevents impulsive decisions that can harm long-term performance.

Common Mistakes Traders Make with Take Profit Orders

Many traders misuse take profit orders, especially when they are new to the markets. These mistakes often come from poor planning or unrealistic expectations.

Placing take-profit levels too close can result in frequent early exits, while placing them too far away can lead to missed profits. A balanced approach, supported by analysis, is more effective over time.

Take Profit Orders in Different Markets

Take profit orders are used across many financial markets, including forex, stocks, indices, and cryptocurrencies. While the concept remains the same, execution can differ slightly.

In fast-moving markets, the price may not close exactly at the take-profit level due to slippage. Understanding how your market behaves helps you set realistic and achievable targets.

Can You Trade Without a Take Profit Order?

Some traders choose not to take profit orders and instead close trades manually. This approach requires constant monitoring and strong emotional control.

While manual exits can work for experienced traders, beginners often benefit from automated exits. Take profit orders provide structure and reduce the risk of emotional mistakes.

When to Adjust or Remove a Take Profit Order

There are times when adjusting a take-profit order makes sense. Strong trends, new market information, or changes in volatility may justify moving your target.

Any adjustment should be based on analysis, not fear or excitement. Moving a take profit randomly often leads to inconsistent results.

Final Thoughts

A take-profit order is more than a technical tool; it is a discipline-building mechanism. It encourages planning, reduces emotional trading, and helps traders approach the market with clear expectations.

By understanding how take profit orders work and using them consistently, traders can improve both their decision-making and long-term performance. Whether you trade occasionally or actively, mastering take-profit orders is a foundational skill worth developing.