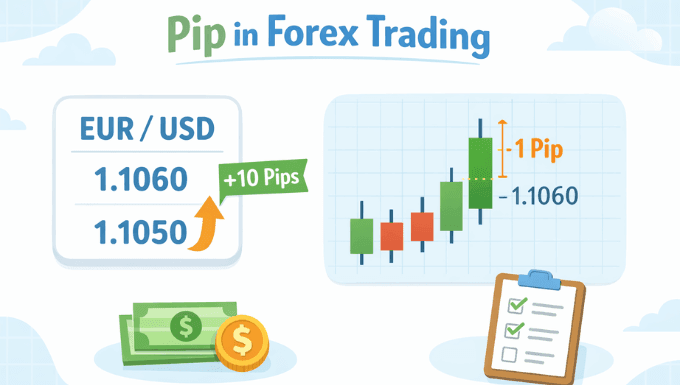

A pip is the standard unit used to measure price movement in the forex market, and it is one of the first concepts every trader must understand. In simple terms, a pip shows how much a currency pair’s exchange rate has moved, helping traders track gains, losses, and market volatility.

Most currency pairs are quoted to four decimal places, and one pip usually represents a move of 0.0001. This small unit may look insignificant at first, but in active markets, pip movements directly determine how much money a trader makes or loses on a position.

Why Pips Matter to Forex Traders

Pips matter because they translate price movement into measurable trading results. Without pips, it would be difficult to compare price changes, calculate profits, or manage risk consistently.

Every trading decision entry, stop loss, take profit, and position size relies on pips. When traders say a trade gained 50 pips or lost 20 pips, they are using a shared language that works across all currency pairs and strategies.

How a Pip Is Calculated

Understanding how a pip is calculated helps traders avoid confusion and costly mistakes. The calculation depends on how a currency pair is quoted.

Standard Currency Pairs (4 Decimal Places)

For most major and minor currency pairs, one pip equals 0.0001. If EUR/USD moves from 1.1000 to 1.1005, the price has moved five pips.

This standardization makes it easy to measure price changes across pairs like GBP/USD, AUD/USD, and NZD/USD.

Japanese Yen Pairs (2 Decimal Places)

Currency pairs involving the Japanese yen are quoted differently. In these pairs, one pip equals 0.01.

For example, if USD/JPY moves from 150.20 to 150.45, the price change is 25 pips. The logic remains the same, even though the decimal placement is different.

What Is a Pipette?

A pipette is a fractional pip used to show more precise price movements. Most modern trading platforms display prices with an extra decimal place.

In this case, one pipette equals one-tenth of a pip. While pipettes add precision, traders still base risk and profit calculations on full pips to keep decisions simple and consistent.

How Much Is a Pip Worth?

The value of a pip depends on three key factors: the currency pair, the trade size, and the account currency. This is where pips move from theory into real money.

Pip Value by Trade Size

Different lot sizes change how much each pip is worth:

- Standard lot (100,000 units): about $10 per pip

- Mini lot (10,000 units): about $1 per pip

- Micro lot (1,000 units): about $0.10 per pip

These values apply when the quote currency is the US dollar. Other pairs may vary slightly due to exchange rates.

Why Pip Value Changes

Pip value changes because currency prices are always relative. If your account currency differs from the quote currency, the platform automatically converts the pip value based on current rates.

This is why traders often use built-in calculators instead of manual formulas, especially when trading multiple pairs.

Pips and Profit or Loss

Pips are the direct link between market movement and trading results. A profitable trade means the price moved in your favor by a certain number of pips, while a losing trade means it moved against you.

For example, if you buy EUR/USD and gain 30 pips on a mini lot, the profit is roughly $30. The same 30-pip move on a standard lot would result in about $300, showing how position size amplifies outcomes.

Pips in Risk Management

Effective risk management starts with understanding pips. Traders define risk not just in terms of money, but also in terms of the pip distance from the entry to the stop loss.

By setting a stop loss at a fixed number of pips, traders control downside risk regardless of market noise. This approach creates consistency and helps prevent emotional decision-making during volatile conditions.

The Difference Between Pips and Points

Many beginners confuse pips with points, especially when switching between brokers or platforms. While a pip is the traditional unit of movement, a point often refers to the smallest price change displayed, which may be a pipette.

The key is to know what unit your platform uses when placing orders or analyzing charts. A clear understanding helps avoid errors in stop-loss placement and trade sizing.

Common Beginner Mistakes with Pips

Misunderstanding pips is a frequent cause of early trading losses. These errors often come from rushing into trades without fully understanding price movement.

Some common mistakes include risking too many pips on a single trade, confusing pip values across pairs, or ignoring how lot size affects pip worth. Avoiding these mistakes starts with slow, deliberate learning and consistent practice.

How Pips Shape Trading Strategies

Every trading strategy is built around pips. Scalpers aim for small pip gains many times a day, while swing traders target larger pip moves over longer periods.

Knowing how many pips a strategy typically gains or loses helps traders evaluate whether it suits their risk tolerance, time commitment, and account size.

Final Thoughts

A pip may be small, but it is the foundation of forex trading. It connects price movement, risk, profit, and strategy into one clear measurement.

By mastering how pips work, traders gain clarity and confidence in their decisions. This understanding does not guarantee success, but it provides the essential framework needed to trade the forex market with discipline and control.