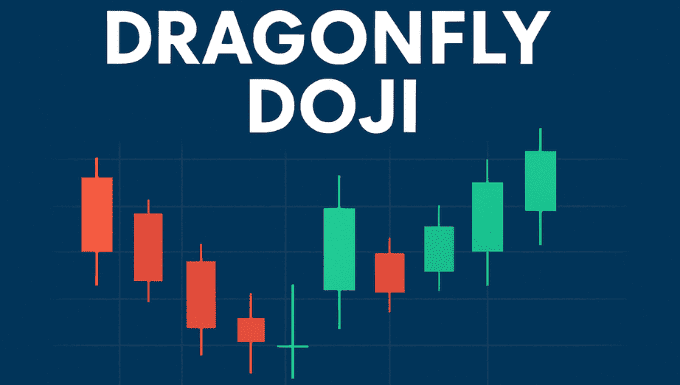

In technical analysis, the Dragonfly Doji is a unique and powerful candlestick pattern that can signal a potential reversal in price trends. Traders across forex, stocks, and crypto markets use it to identify shifts in momentum and improve entry and exit timing. Understanding this pattern can help you make more confident and informed trading decisions.

What is a Dragonfly Doji?

A Dragonfly Doji is a single candlestick pattern with:

- A long lower shadow (wick)

- A flat or nearly invisible body

- Little to no upper shadow

It typically forms when the open, close, and high prices are nearly the same, but the low price dips significantly before recovering. This structure shows that sellers pushed prices lower during the session, but buyers regained control by the close.

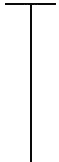

How to Identify a Dragonfly Doji

Key features:

- Long lower shadow – significantly longer than the body.

- Flat top – open, close, and high prices are nearly equal.

- Occurs after a price move – often after a downtrend (bullish signal) or at a market top (potential bearish reversal).

Example in a chart:

- Imagine a long candlestick tail pointing downwards with a short horizontal line at the top — resembling a “T” shape.

What Does a Dragonfly Doji Mean?

The meaning depends on market context:

1. Bullish Reversal Signal

When it appears after a downtrend, it can indicate that sellers are losing strength and buyers are stepping in, signaling a possible upward move.

2. Bearish Reversal or Pause

When it appears after a strong uptrend, it may suggest buyers tried to push higher but faced strong selling pressure — sometimes leading to a price reversal or sideways movement.

Why the Dragonfly Doji Works

The psychology behind the pattern:

- Sellers dominate early in the session, pushing prices down.

- Buyers regain control, bringing prices back to the open level.

- This tug-of-war reflects shifting momentum and potential trend change.

How to Trade the Dragonfly Doji

Step 1: Confirm with Market Context

- Look for the pattern after a clear trend (uptrend or downtrend).

- Avoid trading it in choppy, sideways markets.

Step 2: Use Additional Indicators

Combine with:

- Moving Averages (e.g., 20 EMA, 50 EMA)

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

- Support & resistance zones

Step 3: Entry Strategies

- Bullish trade: Enter above the Dragonfly Doji’s high after a downtrend.

- Bearish trade: Enter below the low after an uptrend.

Step 4: Stop-Loss Placement

- Place stop-loss just below the Dragonfly Doji low (for bullish trades).

- Place stop-loss just above the high (for bearish trades).

Step 5: Take-Profit Levels

- Use recent swing highs/lows or Fibonacci levels to set realistic targets.

Common Mistakes When Trading Dragonfly Doji

- Ignoring overall trend context.

- Trading without confirmation from volume or indicators.

- Mistaking similar candlesticks (like Hammer) for a Dragonfly Doji.

Dragonfly Doji vs. Hammer

While both have long lower shadows and small bodies:

- Dragonfly Doji: Open, high, and close are almost the same.

- Hammer: Has a small real body that is not exactly at the high.

Examples in Different Markets

Forex

A Dragonfly Doji after a GBP/USD downtrend could hint at bullish reversal.

Stocks

Seeing one after a drop in Apple stock might indicate buying interest returning.

Crypto

Bitcoin forming a Dragonfly Doji on daily charts could suggest buyers are fighting back after a dip.

Best Timeframes for Trading Dragonfly Doji

- Daily chart: Stronger signals.

- 4-hour and 1-hour: Good for active traders.

- Avoid low-volume timeframes unless scalping.

Final Tips for Success

- Always confirm with other signals before entering.

- Use proper risk management (never risk more than 1-2% of capital per trade).

- Keep a trading journal to track Dragonfly Doji trades and refine your strategy.