A downtrend is an overall move lower in price, created by lower lows and lower highs. It describes the price movement of a financial asset when the overall direction is downward. In Forex trading, understanding downtrends is essential for identifying market direction, spotting profitable entry points, and managing risks effectively.

In this guide, we will cover everything you need to know about downtrends, including their characteristics, how to identify them, why they happen, and the best ways to trade them.

What is a Downtrend?

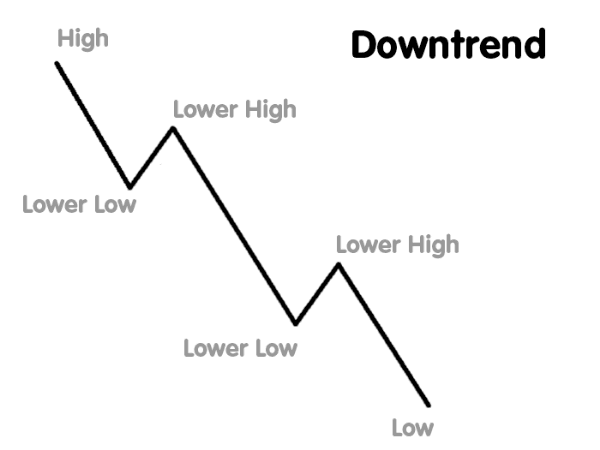

A downtrend occurs when the price of a financial instrument—such as a currency pair, stock, or commodity—moves consistently lower over time. This movement is not straight; rather, it follows a zigzag pattern where each peak (high) and trough (low) is lower than the one before it.

- Lower Highs (LH): Each rally in price is weaker than the last.

- Lower Lows (LL): Each sell-off pushes prices to a new low.

As long as the market keeps forming lower highs and lower lows, the downtrend remains intact.

When the pattern changes and prices begin to create higher lows or higher highs, it signals that the trend might be weakening, ranging, or reversing into an uptrend.

Key Characteristics of a Downtrend

A downtrend can be identified by observing price charts. The following features define it clearly:

1. Lower Peaks and Troughs

- Peaks (Highs): The highest points before the price drops again.

- Troughs (Lows): The lowest points before the price rises again.

In a downtrend, peaks and troughs both move downward progressively. Even though price movement zigzags, the overall trajectory is declining.

2. Bearish Market Sentiment

A downtrend reflects more sellers than buyers. Traders lack confidence, and supply outweighs demand.

3. Breaking of Support Levels

Prices frequently break below previous support levels, creating new lower supports.

4. Trendline Slope

If you draw a trendline along the highs, it will slope downward.

Why Do Downtrends Occur?

Downtrends in financial markets, especially Forex, happen for several reasons:

- Weak Economic Data: Poor GDP growth, high unemployment, or inflation concerns.

- Central Bank Policies: Interest rate cuts or dovish policies often weaken a currency.

- Global Events: Political instability, wars, or financial crises.

- Shift in Sentiment: When traders lose confidence in a currency or asset.

Simply put, a downtrend signals excess supply in the market compared to demand.

How to Identify a Downtrend in Forex

Identifying a downtrend is one of the most crucial skills in trading. Here’s how professionals do it:

1. Price Action Analysis

- Look for lower highs and lower lows.

- Observe candlestick patterns that suggest selling pressure, such as bearish engulfing candles.

2. Trendlines

Draw a line connecting at least two lower highs. The steeper and longer the line, the stronger the downtrend.

3. Moving Averages (MA)

- Price trading below the 20-day or 50-day MA indicates a downtrend.

- Crossovers (e.g., 20 EMA crossing below 50 EMA) confirm bearish momentum.

4. Technical Indicators

- RSI (Relative Strength Index): Values below 50 show bearish conditions.

- MACD: Negative crossovers confirm downtrend strength.

How to Trade a Downtrend

Trading a downtrend requires discipline, patience, and risk management. Traders usually take short positions (selling) during a downtrend.

1. Spotting the Entry Point

- Wait for price to rally towards the trendline or resistance before entering a short.

- Confirm with bearish candlestick signals or volume increases.

2. Placing Stop-Loss Orders

- Stops are usually placed above the last swing high.

- This prevents large losses if the trend unexpectedly reverses.

3. Taking Profit

- Profits can be taken at previous swing lows.

- As the trend develops, move your stop-loss to lock in profits.

Trading Tips for Downtrends

- Look for prices attempting to retest previous highs but failing.

- Place stop-loss orders just above the last swing high.

- Confirm downtrend continuation when prices break below prior lows.

- Take partial profits as price flushes below key support levels.

- Remember: No trend lasts forever—manage risks accordingly.

Mistakes to Avoid in a Downtrend

- Catching a Falling Knife: Avoid buying too early during a strong downtrend.

- Ignoring Fundamentals: Don’t just rely on charts—news events can reverse trends.

- Overleveraging: Never risk too much on one trade.

- Lack of Confirmation: Always wait for confirmation before entering.

Examples of Downtrends in Forex

- EUR/USD 2008 Financial Crisis: The euro lost significant value against the dollar.

- GBP/USD Brexit Referendum (2016): Sharp downtrend due to uncertainty.

- USD/JPY Pandemic Crash (2020): Demand for safe-haven assets pushed yen higher, dollar lower.

These examples show how macroeconomic events fuel powerful downtrends.

Downtrend vs. Uptrend

| Feature | Downtrend | Uptrend |

| Peaks | Lower highs | Higher highs |

| Troughs | Lower lows | Higher lows |

| Sentiment | Bearish | Bullish |

| Trading Strategy | Sell/short | Buy/long |

Understanding both helps traders switch strategies when market conditions change.

When Does a Downtrend End?

A downtrend is questioned when:

- Price breaks above the last lower high.

- Market forms higher lows.

- Technical indicators signal bullish reversal.

- Volume shifts to buying pressure.

At this stage, the market may be transitioning into an uptrend or moving sideways.

Risk Management in Downtrends

- Use Stop-Loss: Always protect your account balance.

- Position Sizing: Never risk more than 1–2% of capital on one trade.

- Diversification: Don’t rely on one asset or pair.

- Review Trades: Learn from wins and losses.

Conclusion

A downtrend is a critical concept in Forex trading, defined by lower highs and lower lows. It represents bearish market conditions and offers opportunities for profit through short-selling strategies.

Traders who master identifying, confirming, and trading downtrends gain a strong edge in the markets. However, no trend lasts forever. Risk management and discipline are essential for long-term success.

By carefully observing chart patterns, technical indicators, and economic events, you can successfully navigate downtrends and turn bearish markets into profitable opportunities.