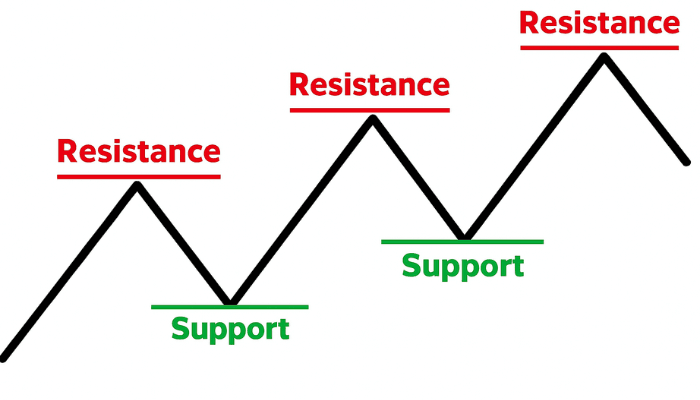

Support and resistance are among the most important concepts in Forex trading. They act like invisible barriers on a chart that tell us where prices might stop, bounce, or reverse. Mastering support and resistance is key to spotting entry and exit points.

What is Support?

Support is a price level where the market tends to stop falling and may bounce back up.

- Think of it like: A “floor” that prevents the price from going lower.

- Why it happens: Buyers see the price as cheap and enter the market, pushing it up.

Example: If EUR/USD keeps bouncing upward around 1.0500, that level is acting as support.

What is Resistance?

Resistance is a price level where the market tends to stop rising and may reverse downward.

- Think of it like: A “ceiling” that prevents the price from going higher.

- Why it happens: Sellers see the price as expensive and take profit or open sell positions.

Example: If GBP/USD fails to rise above 1.3000 several times, that level is resistance.

The Role of Support and Resistance

- They are not exact numbers but zones or areas.

- The more times price touches a level and reverses, the stronger that level becomes.

- Once broken, support often turns into resistance, and resistance can turn into support.

Why They Matter in Trading

- Help traders identify good entry points (buy near support, sell near resistance).

- Help place stop-loss orders safely.

- Act as a foundation for many trading strategies.

Summary

- Support = floor (price stops falling).

- Resistance = ceiling (price stops rising).

- These levels help traders understand where to enter or exit trades.

- Strong support and resistance zones often guide market movement.