The Forex market is open 24 hours a day, 5 days a week. But this does not mean it is always active. The market is divided into trading sessions, based on the world’s major financial centers.

Knowing when to trade is just as important as knowing what to trade.

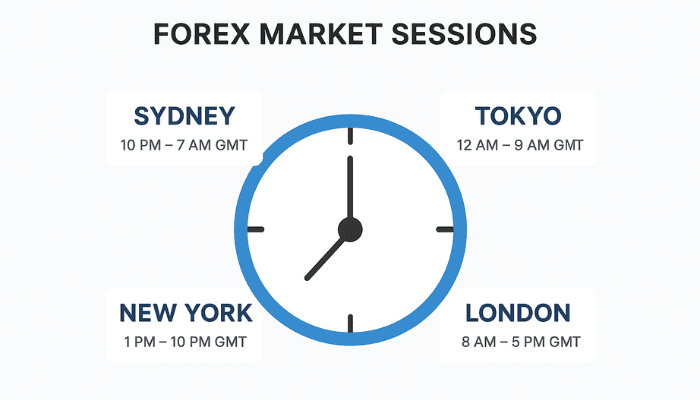

🕒 The Four Major Forex Sessions

- Sydney Session 🦘

- Time: 10:00 PM – 7:00 AM (GMT)

- Region: Australia & Pacific

- Liquidity: Low, market just waking up.

- Best for: AUD, NZD, JPY pairs.

- Tokyo Session (Asian Session) 🏯

- Time: 11:00 PM – 8:00 AM (GMT)

- Region: Japan, Asia.

- Liquidity: Moderate.

- Best for: JPY, AUD, NZD pairs.

- London Session 💂

- Time: 7:00 AM – 4:00 PM (GMT)

- Region: Europe, UK.

- Liquidity: High — London is the world’s forex hub.

- Best for: EUR, GBP, USD pairs.

- New York Session 🗽

- Time: 12:00 PM – 9:00 PM (GMT)

- Region: United States.

- Liquidity: Very high, overlaps with London.

- Best for: USD, CAD, EUR, GBP pairs.

Important Overlaps

- London + New York (12 PM – 4 PM GMT) → Most active, biggest moves, highest liquidity.

- Sydney + Tokyo (11 PM – 2 AM GMT) → Best time for JPY, AUD, NZD trades.

Why Trading Sessions Matter

✔️ Higher liquidity → Lower spreads.

✔️ More volatility → More opportunities.

✔️ Avoid trading during “dead hours” when markets are flat.

Example Scenario

A trader in Kenya (EAT, GMT+3):

- Wants to trade EUR/USD.

- Best time is London & New York overlap (3 PM – 7 PM local time) → Highest volatility, better profits.

Lesson Summary

- The Forex market has 4 major sessions: Sydney, Tokyo, London, and New York.

- The overlap of London & New York is the most active time.

- Choose your trading time based on the pairs you trade.