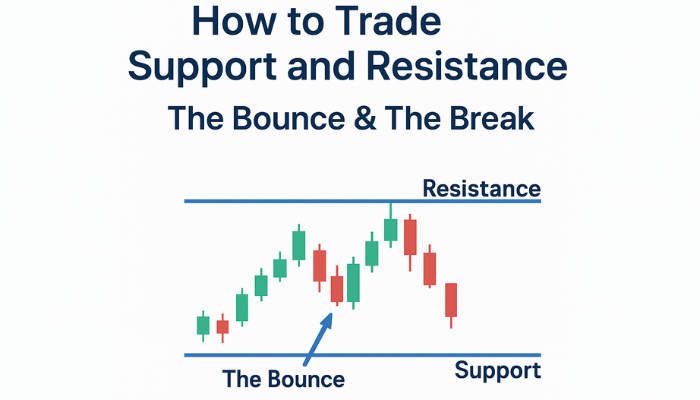

Support and resistance are key concepts in forex trading, but knowing how to trade them is what makes the difference. Price usually reacts in one of two ways when it approaches these levels: it either bounces back or breaks through. Mastering these two scenarios is essential for developing a strong trading strategy.

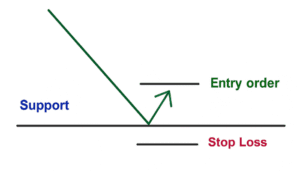

The Bounce

When price approaches a support or resistance level and reverses direction, it’s called a bounce. Traders use this to predict that price will respect the level and move in the opposite direction.

How to trade the bounce:

- Identify a clear support or resistance level.

- Wait for price to approach the level.

- Look for confirmation signals such as candlestick patterns, trend lines, or indicators.

- Enter a trade in the opposite direction (buy at support, sell at resistance).

- Place your stop-loss just beyond the level to manage risk.

The bounce is more reliable when the level has been tested multiple times and price reacts strongly.

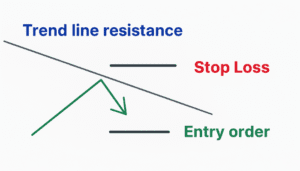

The Break

A break happens when price pushes through a support or resistance level and continues moving in that direction. This usually signals strong momentum and can mark the beginning of a new trend.

How to trade the break:

- Identify a strong support or resistance level.

- Wait for price to close beyond the level (not just a quick spike).

- Confirm the breakout with volume or momentum indicators.

- Enter the trade in the direction of the breakout.

- Place your stop-loss just inside the broken level to protect against false breakouts.

Avoiding False Breakouts

False breakouts occur when price briefly moves beyond a level but quickly reverses back. To avoid being trapped:

- Wait for a confirmed candle close beyond the level.

- Use additional confirmation tools like RSI or MACD.

- Consider waiting for a retest of the broken level before entering.

Summary

Support and resistance trading revolves around two main reactions: the bounce and the break. The bounce offers opportunities to trade reversals, while the break signals momentum and potential new trends. Successful traders combine patience, confirmation signals, and strict risk management to handle both situations effectively.